Do Brokers Have Local Offices? Does It Matter?

Discover how local offices enhance brokers’ credibility and support services. Learn why brokers like eToro, AvaTrade US use regional offices to strengthen trader relationships.

Writen by:

Arslan Ali But

23 January 2025

5 minutes read

Writen by:

Arslan Ali But

23 January 2025

5 minutes read

In the competitive world of trading, choosing the right broker is crucial for a secure and seamless trading experience. While technology has enabled brokers to serve clients globally, having a local office remains a valuable asset for building trust and offering personalized support.

Local offices not only demonstrate a broker’s commitment to the region but also provide traders with access to face-to-face assistance for account issues, regulatory compliance, and dispute resolution.

This article explores the significance of local offices in enhancing the trader-broker relationship, using brokers like eToro, AvaTrade US as examples to highlight the tangible benefits they provide to traders.

Why Do Local Offices Matter?

Trust and Credibility

A broker’s physical office demonstrates its commitment to a specific region, enhancing trust and credibility. It indicates adherence to local regulations, which assures traders of their investments' safety.

-

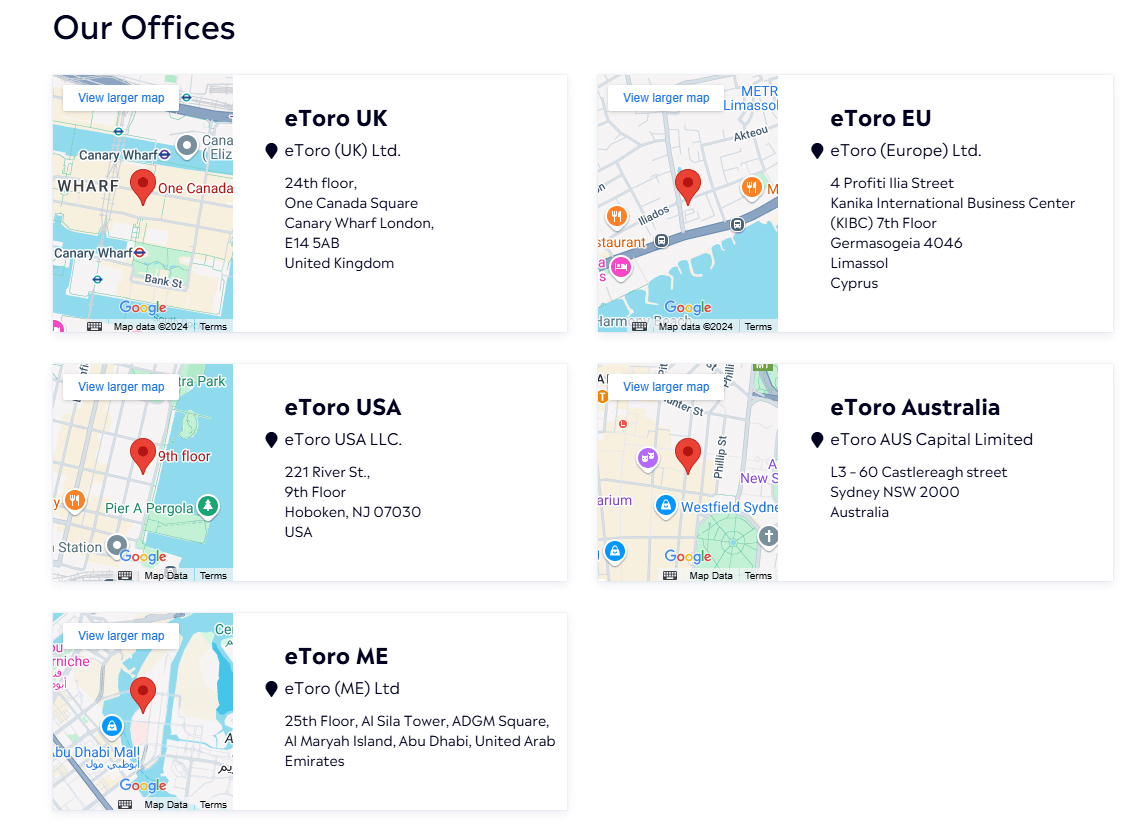

eToro UK:

Located at 24th Floor, One Canada Square, Canary Wharf, London, E14 5AB, eToro’s London office reflects its dedication to serving UK traders under the oversight of the Financial Conduct Authority (FCA).

-

AvaTrade:

Operating offices in regions like Dublin, Ireland, AvaTrade provides local support, adhering to EU regulations enforced by the Central Bank of Ireland.

Ease of Communication:

Local offices provide direct, in-person interactions, resolving issues faster than online communication. For example: eToro’s London office offers personalized support for account concerns.

Key Benefits of Local Offices

Local offices offer traders practical advantages, including enhanced support, compliance expertise, and effective conflict resolution.

-

eToro London:

While eToro primarily supports clients online, its UK office reflects a commitment to regional presence and FCA compliance.

Local Market Knowledge:

Brokers with regional offices possess insights into local regulations and tax requirements, ensuring compliance and tailored support.

-

AvaTrade’s Dublin Office: AvaTrade operates in Dublin, Ireland, adhering to EU regulations enforced by the Central Bank of Ireland. While local expertise is beneficial, specific services like personalized tax assistance are not explicitly offered.

Conflict Resolution:

Face-to-face interactions can expedite dispute resolution; however, many brokers have established efficient online and remote processes to handle conflicts.

How Local Offices Facilitate Regulatory Compliance

Local offices are essential for brokers to meet regional legal and compliance standards while ensuring transparency and protecting client funds.

1. Adherence to Local Regulations:

Local offices enable brokers to comply with specific laws set by regional authorities, reinforcing credibility. For example: eToro’s London office complies with the Financial Conduct Authority (FCA) requirements, ensuring proper fund segregation and operational transparency. AvaTrade, headquartered in Dublin, adheres to EU standards enforced by the Central Bank of Ireland.

2. Transparency and Client Security:

Local offices facilitate investor protection programs, safeguarding client deposits under regional laws. For example: eToro UK clients are covered by the Financial Services Compensation Scheme (FSCS) for up to £85,000, while eToro Europe clients benefit from the Cyprus Investor Compensation Fund (ICF) with protection up to €20,000.

Local Offices in Forex, Crypto, and Stock Markets

Forex: Brokers with local offices provide forex traders with region-specific support and services tailored to local regulations.

-

Example: eToro’s London office enhances client support by aligning with FCA guidelines.

Crypto: Local offices are crucial for navigating crypto regulations, fostering trust, and ensuring compliance with regional laws.

-

Example: Binance Singapore secured licensing under the Monetary Authority of Singapore (MAS), highlighting the importance of local presence in a highly regulated market.

Stock Markets: The centralized nature of stock markets requires strict regulatory compliance and transparency, which local offices facilitate.

-

Example: Brokers like eToro align with regional stock market regulations through local offices, ensuring adherence to disclosure and reporting requirements mandated by authorities like the FCA and CySEC.

Local offices ensure brokers provide tailored support, maintain compliance, and promote transparency across all market types.

The Future of Local Offices in Trading

The rise of digital platforms has made remote trading the norm, reducing the dependency on physical offices. However, hybrid models combining online services with in-person support are becoming increasingly valuable, particularly for resolving complex issues or providing personalized guidance.

Challenges: Opening and maintaining local offices globally involves significant costs and logistical hurdles. Regulatory challenges in some regions also make it difficult for brokers to establish physical locations.

For example: Many brokers, including eToro, effectively serve clients in multiple regions without local offices by leveraging robust online platforms and localized support teams.

As trading continues to evolve, the balance between digital innovation and the traditional benefits of local offices will shape the industry's future.

Conclusion

Local offices play a vital role in building trust, offering tailored services, and ensuring compliance with regional regulations. Traders benefit from personalized support and increased transparency. Choose brokers with local offices for a secure, reliable trading experience. At WhereToTrade, we connect you with regulated platforms that prioritize transparency and client safety.

Table of contents

1. Why Do Local Offices Matter? 2. How Local Offices Facilitate Regulatory Compliance 3. Local Offices in Forex, Crypto, and Stock Markets 4. Challenges and the Future of Market Regulation 5. Conclusion