Trading Commodities: Gold, Oil, and More

Explore commodities trading with insights on gold, oil, and agricultural markets. Learn methods, price drivers, and tips for successful trading.

Writen by:

Arslan Ali But

26 January 2025

8 minutes read

Writen by:

Arslan Ali But

26 January 2025

8 minutes read

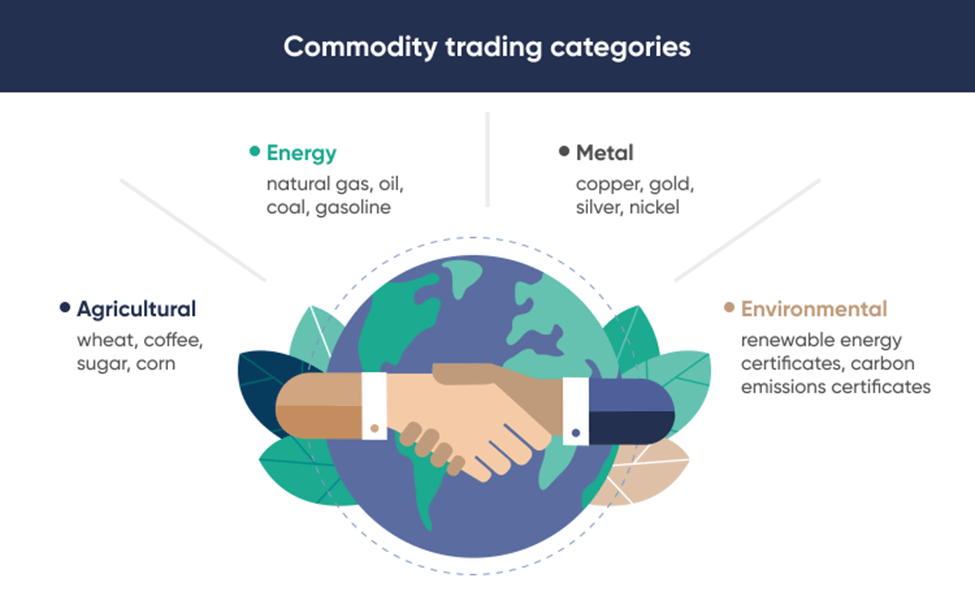

Commodities, including raw materials and agricultural products, are the backbone of global financial markets. They are divided into hard commodities like gold, oil, and natural gas, and soft commodities such as wheat, coffee, and sugar. These essential assets drive industries, influence consumer goods, and impact economies worldwide.

- Gold: Known as a safe-haven asset, gold provides stability during economic uncertainty.

- Oil: A cornerstone of global energy, oil powers industries and transportation.

- Agricultural Products: Critical for food security, they play a vital role in global trade and consumption.

Key Trading Methods

- Futures Contracts: Allow traders to speculate on price movements of commodities at a future date.

- Exchange-Traded Funds (ETFs): Simplify investments by offering exposure to commodity baskets.

- Contracts for Difference (CFDs): Enable speculation on price changes without owning physical commodities.

Commodity trading is not only accessible but also integral for diversifying investment portfolios, making it a crucial aspect of modern financial markets.

Why Trade Commodities?

Curious about how commodities can protect your portfolio from economic uncertainties? Commodities trading offers investors a way to diversify and hedge against market volatility. Unlike stocks and bonds, commodities are influenced by distinct factors, offering unique opportunities.

- Inflation Hedge: Gold remains a reliable store of value. In October 2024, it hit an all-time high of $2,790.15 per ounce, reflecting its appeal during inflationary pressures.

- Profit from Volatility: Oil prices surged by 18% in Q3 2024, driven by OPEC production cuts and heightened demand in Asia, showcasing how energy markets react to geopolitical shifts.

- Risk Management: Agricultural commodities like wheat rose 12% in 2024 due to adverse weather, creating opportunities for traders to hedge risks or capitalize on trends.

By navigating these dynamics, traders can protect their portfolios while leveraging price fluctuations for growth.

Popular Commodities to Trade

Ever wondered why oil prices fluctuate so dramatically or why gold is a safe-haven asset during crises? The commodities market spans diverse sectors, from energy to precious metals and agricultural products. Each commodity offers unique opportunities influenced by its own market dynamics.

1. Energy Commodities:

-

Crude Oil:

- Brent Crude: Serves as a global benchmark for oil prices. In 2024, Brent Crude prices have shown variability, reflecting changes in global demand and geopolitical factors.

- West Texas Intermediate (WTI): A benchmark for U.S. oil prices, WTI has experienced similar volatility, influenced by domestic production levels and international market dynamics.

- Natural Gas: Prices have been affected by seasonal demand fluctuations and geopolitical developments. In 2024, natural gas markets have experienced periods of both surges and declines, highlighting the commodity's sensitivity to external factors.

2. Precious Metals:

- Gold: Gold has maintained its status as a store of value, experiencing a significant rise amid ongoing economic uncertainties. In October 2024, gold reached an all-time high of $2,790.15 per ounce, marking a substantial increase from previous years

- Silver: Valued for both investment and industrial applications, silver prices have shown relative stability in 2024, with slight fluctuations corresponding to market demand and industrial usage trends.

3. Agricultural Commodities:

-

Corn, Wheat, and Soybean Oil:

- Corn: A crucial biofuel component, corn contributes to nearly 35% of global ethanol production.

- Wheat: Global wheat prices increased by 19% in 2022 due to geopolitical tensions and disrupted supply chains.

- Soybean Oil: A key ingredient in biodiesel, soybean oil demand is projected to grow by 10% annually through 2025, fueled by its versatility.

Key Factors Influencing Commodity Prices

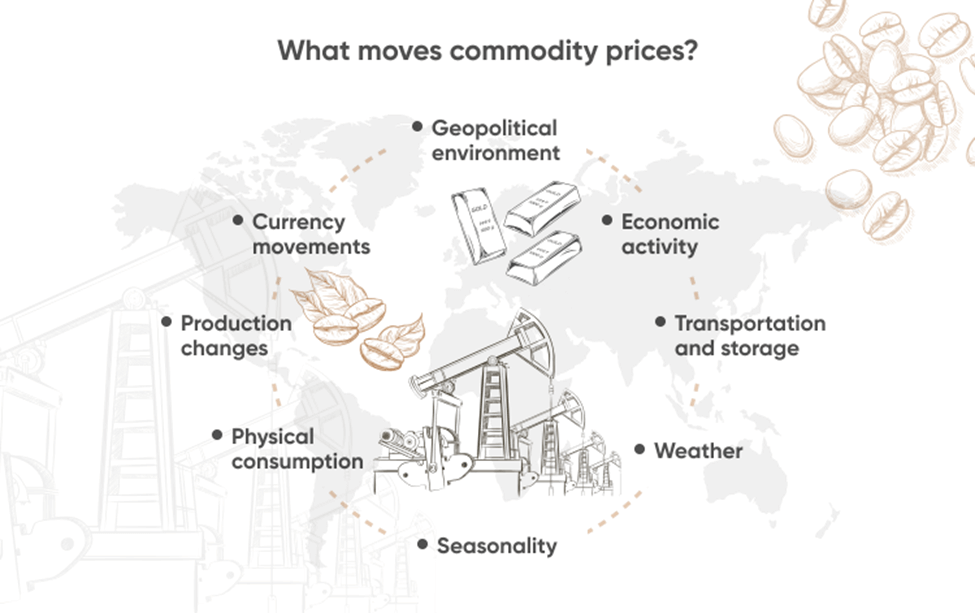

What drives the dramatic swings in oil prices or the steady rise of gold? Commodity prices are shaped by a mix of supply-demand mechanics, economic indicators, and global events. Understanding these factors is crucial for spotting trends and making informed trading decisions.

1. Supply and Demand Dynamics

The fundamental principle of supply and demand governs commodity prices across sectors:

- Energy Commodities: Crude oil prices have experienced fluctuations in 2024. For instance, in April 2024, Brent Crude prices rose to over $91 per barrel, marking an 18% increase for the year, driven by high demand, supply issues, and geopolitical tensions in the Middle East.

- Agricultural Products: In 2024, wheat prices rose by 12% following drought conditions in key exporting countries like the U.S. and Australia.

2. Economic Releases

Economic indicators directly impact commodity demand:

- GDP Growth: Key economic indicators like GDP growth, inflation rates, and employment reports significantly influence commodity prices. Strong economic growth often leads to higher demand for raw materials and energy, driving up prices, while inflation concerns can increase the appeal of commodities like gold. Global crude oil demand grew by 3.2% in 2024, driven by economic recoveries in emerging markets.

- Inflation Rates: Gold prices reached an all-time high of $2,790.15 per ounce in 2024, as investors sought inflation protection amid rising consumer prices.

3. Global Events

Geopolitical and natural events significantly influence prices:

- Geopolitical Tensions: Conflicts in the Middle East led to a 20% surge in crude oil prices in Q3 2024.

- Natural Disasters: Floods in Southeast Asia reduced rice exports by 15%, leading to higher global prices.

4. US Dollar and Interest Rates

Commodities are sensitive to the strength of the U.S. dollar:

- Stronger Dollar: In 2024, the U.S. dollar index rose by 8%, suppressing demand for non-dollar buyers and tempering commodity price growth.

- Interest Rates: Higher U.S. interest rates decreased gold’s appeal for speculative investors despite its safe-haven status.

Methods to Trade Commodities

Thinking about entering the commodities market but unsure where to start? With multiple trading methods like futures contracts, CFDs, and ETFs, there’s an option for every trading style and risk appetite.

Futures Contracts

Futures trading involves agreements to buy or sell a commodity at a predetermined price and date. These contracts are central to commodity markets, allowing traders to speculate on price movements or hedge against risks.

- Advantages: High liquidity and transparency make futures appealing to retail traders.

- Risks: Leverage amplifies both potential profits and losses. For instance, in 2024, crude oil futures saw price swings exceeding 15% due to geopolitical tensions and production adjustments, emphasizing the volatility of futures markets.

Commodity CFDs

Contracts for Difference (CFDs) enable traders to speculate on commodity price changes without owning the physical asset.

- Benefits: Flexibility to profit from both rising and falling prices, coupled with accessibility and leverage.

- Challenges: High leverage increases exposure to significant losses, especially in volatile markets. For example, gold CFDs in 2024 experienced notable fluctuations as prices peaked near $2,700 per ounce.

ETFs and Stocks

Exchange-Traded Funds (ETFs) provide a simplified way to invest in baskets of commodities, while stocks of commodity-focused companies offer indirect market exposure.

- Use Cases: ETFs like SPDR Gold Shares (GLD) provide a lower-risk option for gold investment, while energy stocks like ExxonMobil offer indirect exposure to oil markets.

- Suitability: Ideal for long-term investors seeking diversification with lower risk.

Each method caters to specific goals, offering unique benefits and challenges for traders.

Steps to Start Trading Commodities

Embarking on commodity trading requires preparation and strategy. Here’s how to get started:

- Choose a Trading Platform Select a reputable platform offering commodity markets, such as eToro for diversified products for forex-linked commodities. Opt for account types (standard or margin) that align with your goals.

- Research Commodity Markets Gain insights into the commodities you wish to trade. For example, understand how seasonal trends affect wheat prices or how geopolitical tensions impact crude oil.

- Monitor Economic Indicators Stay updated on economic data like GDP growth, inflation rates, and global events. In 2024, geopolitical tensions in the Middle East caused crude oil prices to spike by 12% within weeks.

- Develop a Risk Management Strategy Set clear stop-loss and take-profit levels for every trade to protect your capital and lock in gains. Managing risk ensures sustainability in volatile markets.

By combining knowledge, discipline, and a strategic approach, traders can confidently navigate the dynamic world of commodities.

Tips for Successful Commodity Trading

Success in commodity trading hinges on strategy, discipline, and adaptability. Consider these essential tips:

- Diversify Your Portfolio: Spread investments across sectors like energy, agriculture, and metals. For instance, balancing gold with crude oil and soybean futures can mitigate sector-specific risks.

- Stay Informed: Keep tabs on economic releases and global news. In 2024, natural disasters in Southeast Asia reduced rice exports by 20%, significantly affecting global agricultural prices.

- Understand Leverage: Leverage magnifies returns but also risks. For example, a 5% price drop in oil futures with 10:1 leverage can result in a 50% loss on capital.

- Know When to Exit: Set and adhere to profit targets and stop-loss levels to secure gains and limit losses.

Challenges in Commodity Trading

Commodity trading is inherently volatile, with prices influenced by unpredictable factors:

- High Volatility: In 2024, crude oil experienced a 20% price swing within a single quarter due to OPEC’s production decisions.

- Leverage Risks: Amplified exposure can lead to forced liquidations during sudden price dips, emphasizing the need for disciplined margin management.

- Global Events: Geopolitical tensions and natural disasters often create abrupt price movements. For instance, droughts in the U.S. and Australia pushed wheat prices up by 15% in 2024.

To overcome these challenges, traders must adopt robust risk management strategies and stay attuned to market dynamics.

Conclusion

Commodity trading offers unparalleled opportunities for diversification, profit, and protection against economic uncertainty. Assets like gold, oil, and agricultural products play pivotal roles in global economies, providing avenues for both growth and stability.

For traders, success lies in understanding market dynamics, employing effective risk management, and staying informed about global trends. By integrating commodities into their portfolios, investors can enhance resilience and navigate financial markets with confidence.

Ready to trade commodities with confidence? Discover trusted platforms at WhereToTrade and start your journey today.

Table of contents

1. Why Trade Commodities? 2. Key Factors Influencing Commodity Prices 3. Methods to Trade Commodities 4. Steps to Start Trading Commodities 5. Conclusion