ActivTrades Review 2025Discover ActivTrades’ trading platforms, account options, fee structure, and regulatory compliance. See if it’s the right broker for your trading journey in 2025.

Last updated

07.02.2025

Key highlights:

Why Choose ActivTrades?

What is ActivTrades? A Leading Forex Broker

Founded in 2001, ActivTrades is a globally recognized online broker specializing in forex, CFDs, and other financial instruments. Headquartered in London, the broker has expanded its presence worldwide, serving a diverse client base across Europe, Asia, the Middle East, and beyond. ActivTrades is known for its strong regulatory framework, innovative trading platforms, and commitment to providing a secure and transparent trading environment.

With over two decades of industry experience, ActivTrades has built a reputation for reliability and excellence in the financial markets.

ActivTrades clients benefit from a wide range of tradable instruments, competitive fees, and strong customer support, all of which contribute to a positive trading experience. Additionally, clients benefit from private insurance coverage, enhancing the overall trust in the broker's reliability.

The broker’s mission is to empower traders of all levels with advanced tools, competitive trading conditions, and comprehensive educational resources, enabling them to navigate global markets with confidence. Whether you’re a beginner looking to explore the world of trading or an experienced professional seeking advanced trading infrastructure, ActivTrades offers the flexibility, security, and support needed to enhance your trading journey.

Key Offerings

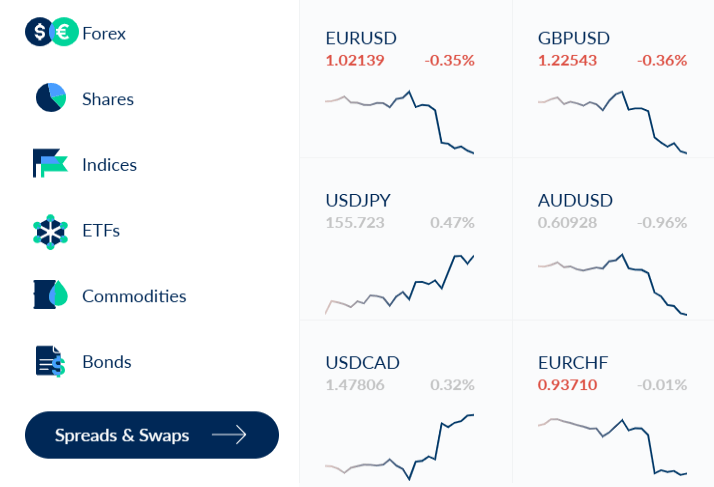

Diverse Instruments: ActivTrades offers a wide range of tradable instruments, allowing clients to diversify their portfolios across global financial markets:

Innovative Platforms: ActivTrades provides powerful trading platforms designed to meet the needs of both beginners and professional traders:

ActivTrades' trading services include low spreads and leverage options, catering to different trader preferences.

Regulatory Compliance: ActivTrades operates under strict regulatory frameworks to ensure the highest standards of client protection and transparency:

ActivTrades’ strong commitment to regulatory compliance provides clients with peace of mind, knowing their funds and personal information are protected within a secure trading environment.

Features and Benefits

ActivTrades distinguishes itself in the competitive brokerage landscape as a reliable forex broker with advanced technology, flexible account options, strong regulatory compliance, and trader-centric tools. With over two decades of industry experience, ActivTrades caters to both beginners and professional traders, providing a secure, dynamic, and efficient trading environment.

The broker supports clients from over 140 countries, offering access to a wide range of financial markets with competitive spreads and state-of-the-art platforms. ActivTrades' extensive experience in the trading industry showcases its credibility and reliability.

Trading Platforms

ActivTrades offers a suite of cutting-edge trading platforms designed to meet the diverse needs of traders:

ActivTrader:

MetaTrader 4 (MT4) & MetaTrader 5 (MT5):

WebTrader:

TradingView:

Copy Trading (if applicable):

Account Types

ActivTrades offers a variety of account types to suit different trading styles and experience levels:

Ideal for beginners, this risk-free account allows users to practice trading with virtual funds (up to 100,000 in virtual currency). It’s perfect for testing strategies, exploring platform features, and gaining confidence without risking real money.

Designed for everyday traders, this account offers competitive spreads starting from 0.5 pips, no minimum deposit requirement, and access to all trading instruments. It’s suitable for traders who want flexibility and cost-effective trading conditions.

Tailored for experienced traders who meet specific criteria (such as a financial portfolio exceeding 500,000 EUR, relevant trading experience, or professional qualifications). This account offers higher leverage of up to 1:400, reduced margin requirements, and advanced trading tools to support sophisticated strategies.

A swap-free account that complies with Sharia law, catering to Muslim traders. It eliminates interest-based rollover fees while maintaining competitive spreads, ensuring ethical trading without compromising on performance.

Specifically designed for businesses and institutional clients, offering customized trading conditions, dedicated account managers, and tailored solutions to meet corporate trading needs. This account supports large-volume trading with enhanced security protocols.

Fees and Charges

Understanding the fee structure is essential for traders to manage their costs effectively. ActivTrades maintains a competitive and transparent pricing model designed to suit both retail and professional traders. The broker aims to keep trading costs low while providing access to advanced platforms and superior trading conditions. Trading CFDs can involve commissions, particularly for shares CFDs, and it's important to be aware of the potential costs involved.

Trading Costs:

ActivTrades offers highly competitive spreads starting from as low as 0.5 pips on major currency pairs like EUR/USD. The actual spread varies depending on the account type, trading instrument, and market conditions. For example, spreads on indices like the S&P 500 can start from 0.23 points, while commodities like gold (XAU/USD) may have spreads starting from 0.25 pips.

For most accounts, ActivTrades operates on a spread-only model, meaning there are no additional commissions for forex and CFD trades. However, for specialized instruments such as shares CFDs, a commission may apply. For example, commissions on share CFDs typically start from 0.01 USD per share or the equivalent in other currencies, depending on the exchange.

When holding positions overnight, traders are subject to swap or rollover fees, which can be either a cost or a credit, depending on the position and market rates. These fees are calculated based on the interest rate differential between the two currencies in a forex pair or the cost of financing a leveraged position in CFDs.

A long position on EUR/USD held overnight may incur a swap fee of -1.2 points, while a short position might generate a credit of +0.8 points, depending on prevailing interest rates.

Non-Trading Fees:

ActivTrades does not charge any fees for deposits or withdrawals made via credit/debit cards or e-wallets like PayPal, Skrill, and Neteller. However, bank wire transfers may incur charges depending on the intermediary banks involved, typically around 15–20 USD per transaction for international transfers.

ActivTrades applies an inactivity fee to accounts that remain dormant for 12 consecutive months. The fee is usually around 10 EUR (or equivalent) per month until the account is reactivated or the balance reaches zero. This ensures resources are allocated efficiently to active traders.

There are no hidden administrative fees. ActivTrades is transparent about its pricing, and all costs related to trading, deposits, and withdrawals are clearly outlined on their website. Additionally, accounts are protected against negative balances, meaning traders won’t incur unexpected debts due to extreme market volatility.

ActivTrades’ cost structure is designed to be competitive while offering excellent value through tight spreads, commission-free trading on most instruments, and minimal non-trading fees. This makes it an attractive choice for cost-conscious traders seeking a reliable and transparent broker.

Regulation and Security

Regulation and security are critical factors when choosing a broker, and ActivTrades excels in both areas. The company is committed to maintaining the highest standards of client protection through strong regulatory compliance and advanced security measures. This ensures traders can operate with confidence, knowing their funds and personal data are safeguarded. However, it is important to note that trading complex instruments like CFDs can lead to losing money rapidly due to leverage. A significant percentage of retail investor accounts face losses when engaging in these trades, so individuals should fully understand the risks involved before participating.

Regulatory Oversight

ActivTrades operates under strict regulatory frameworks across multiple jurisdictions, adhering to global financial standards to ensure transparency and client protection. The broker holds licenses from several top-tier financial authorities:

This robust regulatory framework reflects ActivTrades’ commitment to maintaining a secure and transparent trading environment for its global client base.

Security Measures and Negative Balance Protection

ActivTrades prioritizes client security, implementing advanced measures to protect funds and personal information

All client funds are held in segregated accounts with top-tier banks, separate from the company’s operational funds. This ensures that client money is protected even in the unlikely event of company insolvency.

ActivTrades offers negative balance protection across all account types, ensuring that clients can never lose more than their account balance, even during extreme market volatility. This feature is particularly important during high-impact events that cause rapid price movements.

To enhance account security, ActivTrades supports 2FA, adding an extra layer of protection against unauthorized access. Clients are required to verify their identity through a secondary device when logging in or performing sensitive actions.

All data transmitted between clients and ActivTrades’ servers is protected using 256-bit SSL encryption, the same level of security used by leading financial institutions. Additionally, ActivTrades complies with GDPR (General Data Protection Regulation), ensuring the privacy and protection of client information.

These comprehensive security protocols demonstrate ActivTrades’ dedication to providing a safe, transparent, and trustworthy trading environment. Whether you’re a retail trader or an institutional client, you can trade with confidence, knowing your funds and data are well-protected.

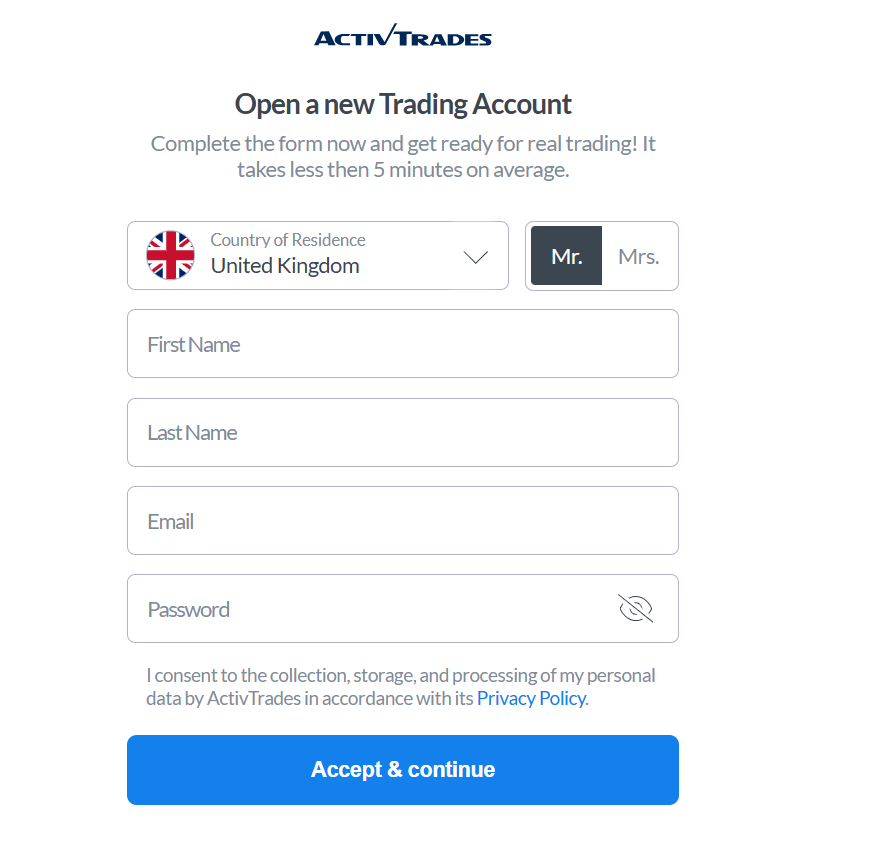

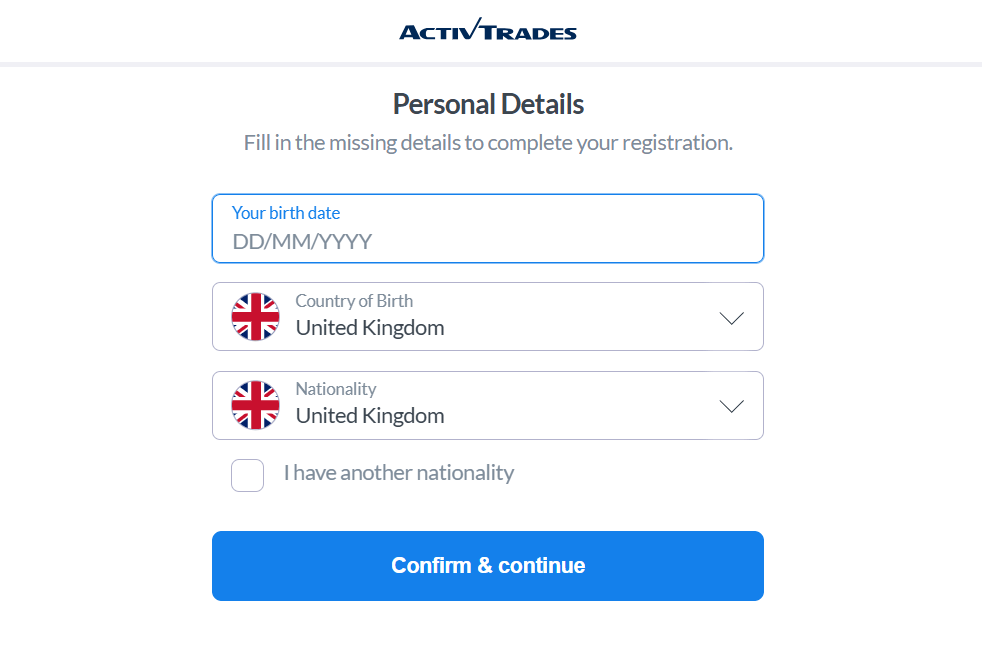

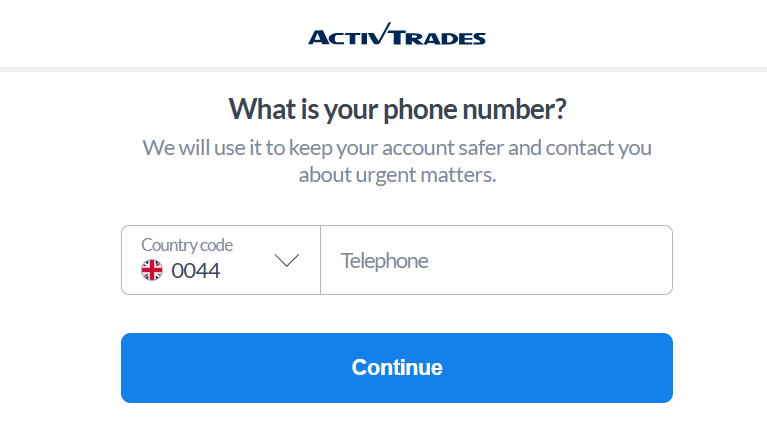

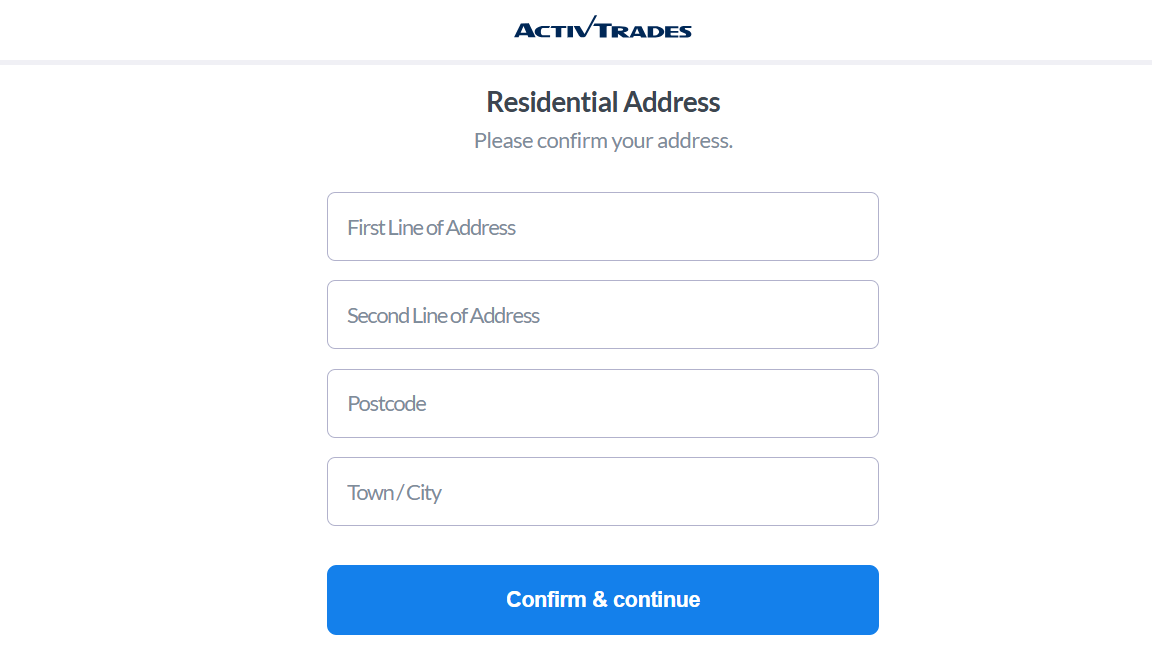

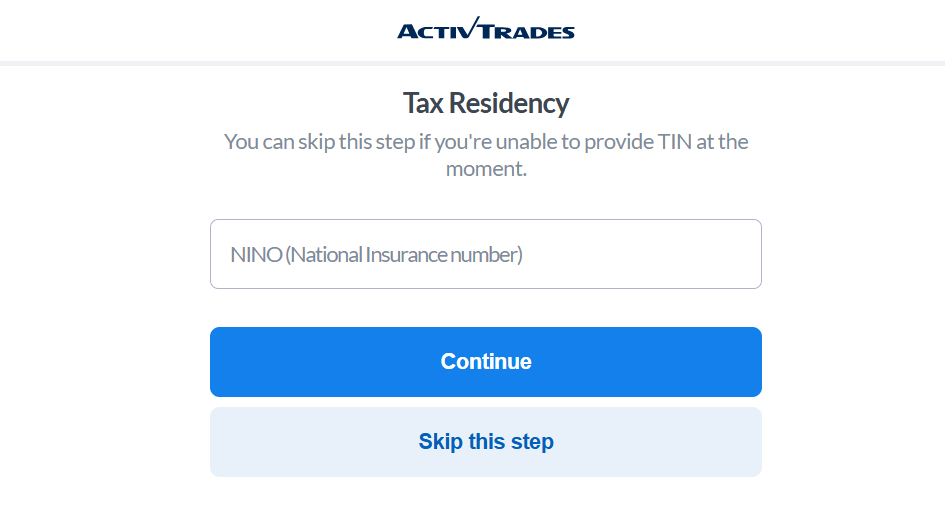

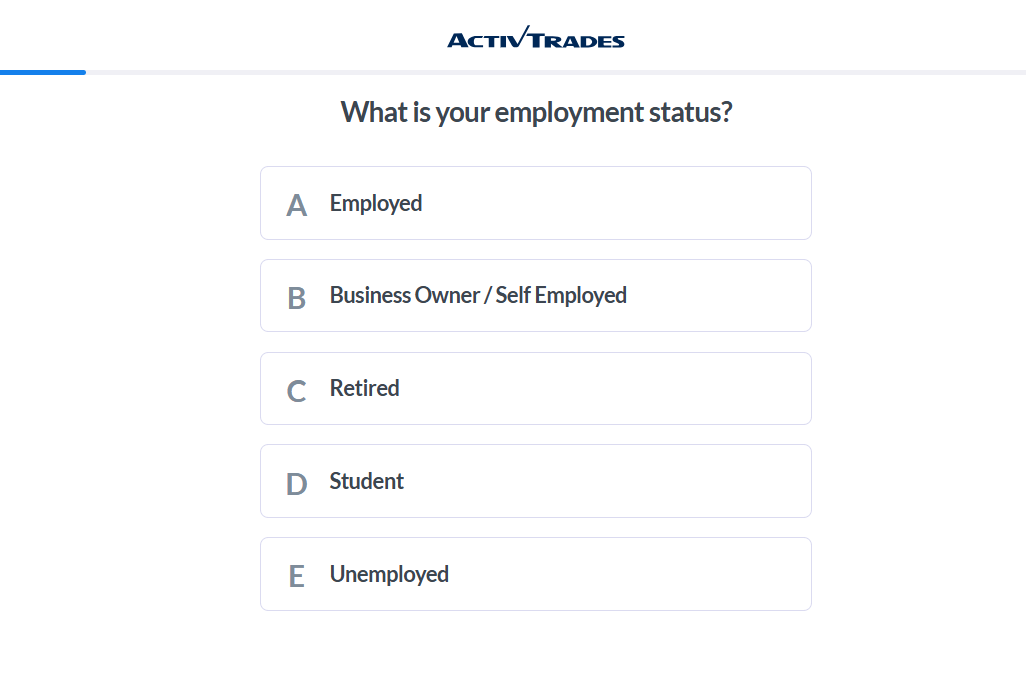

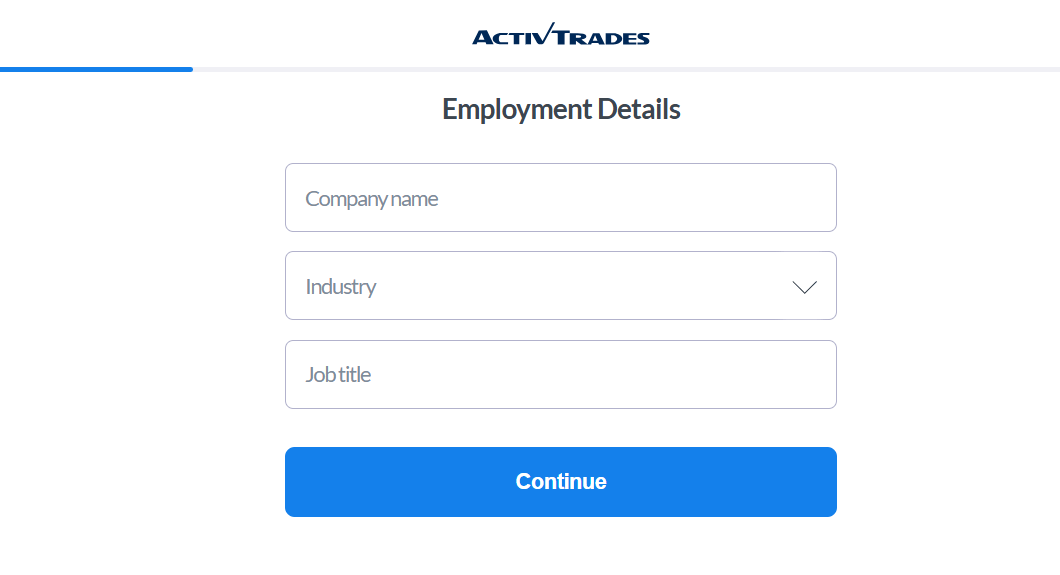

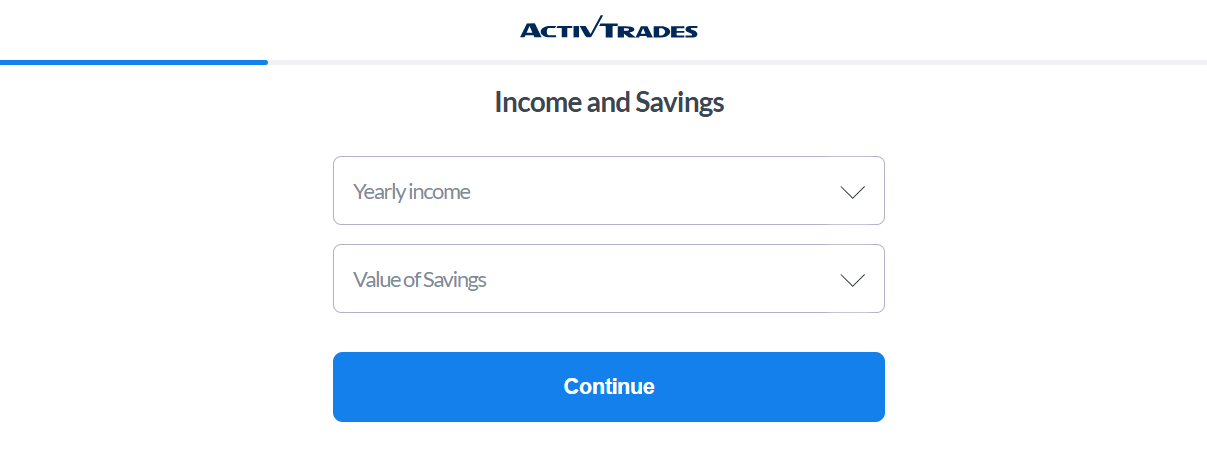

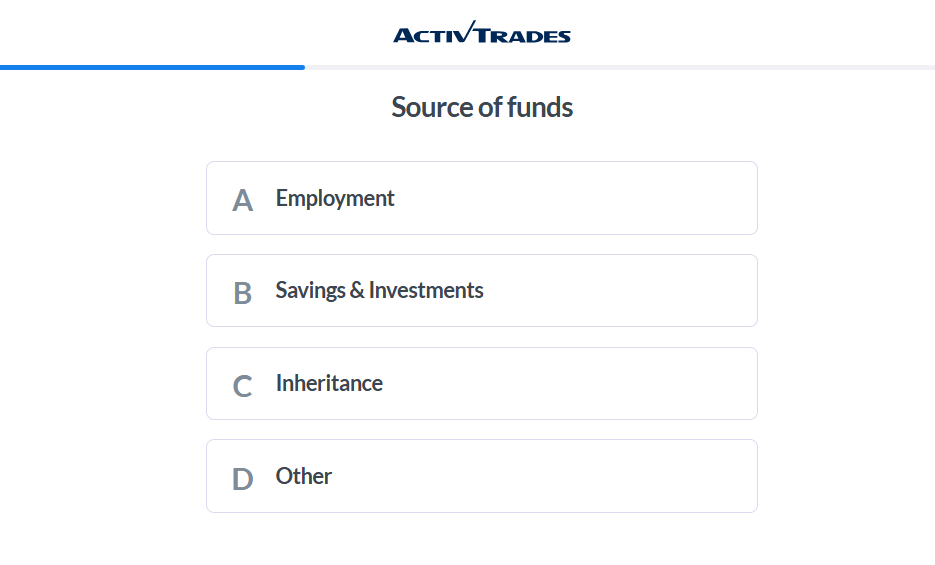

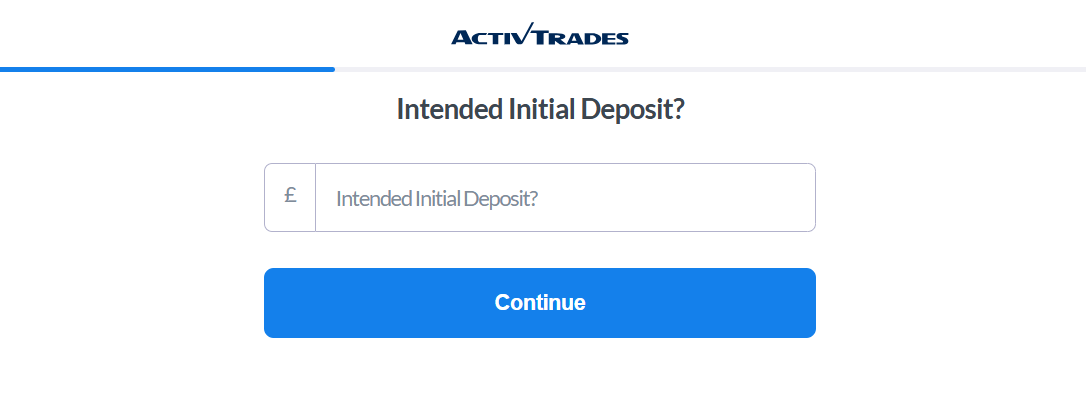

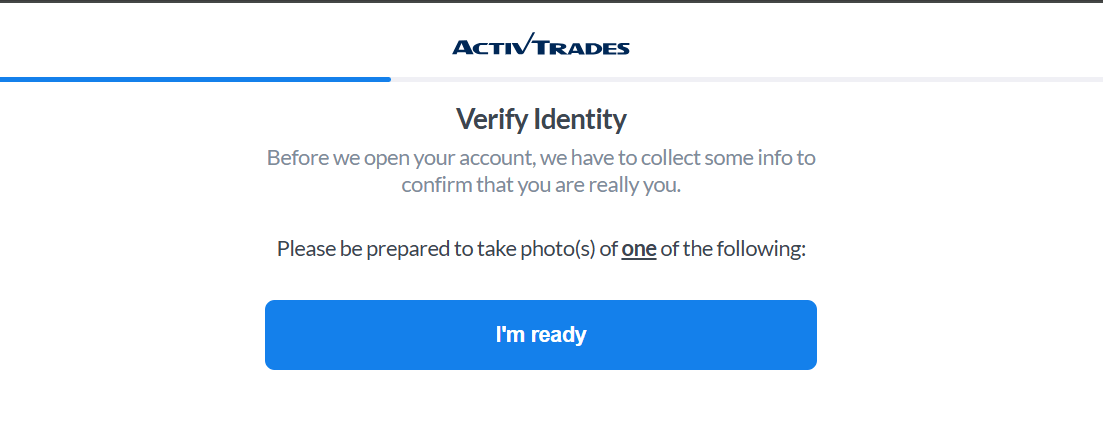

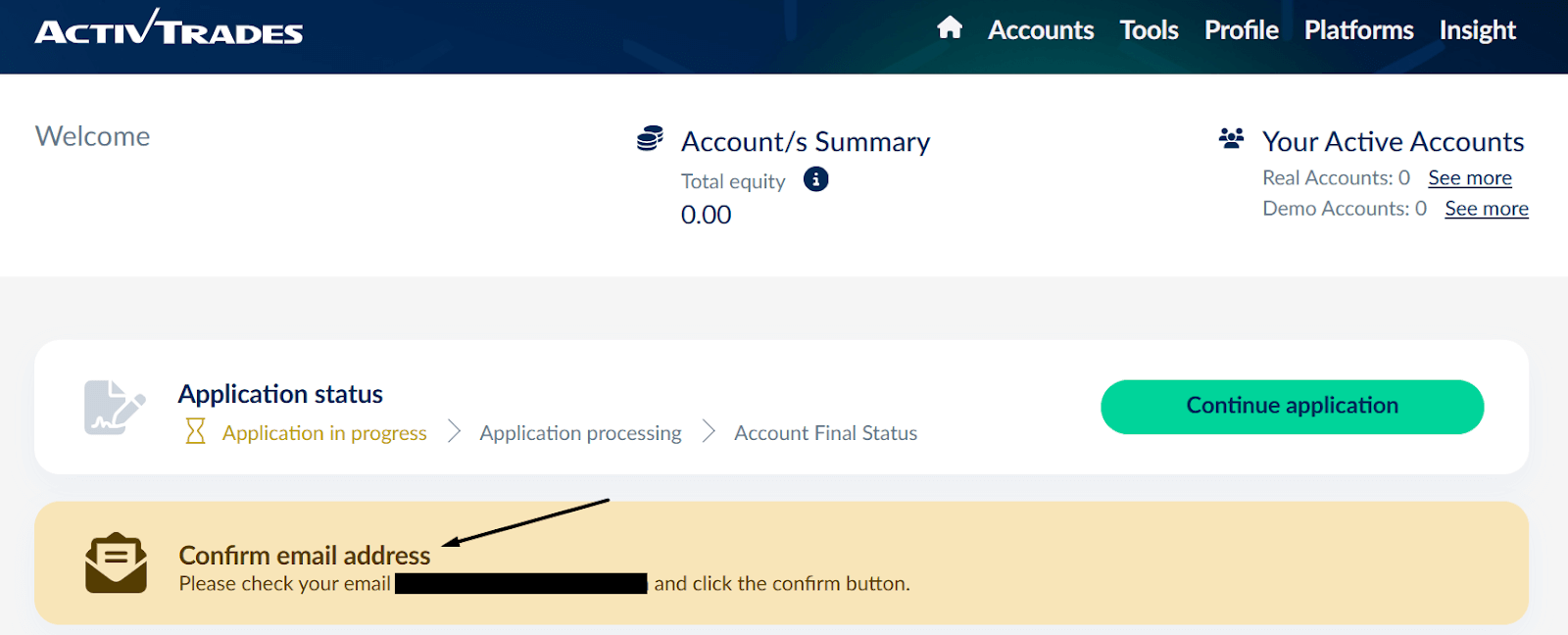

Onboarding Process: How to Open an Account

Opening an account with ActivTrades is straightforward, designed to be quick and user-friendly. Whether you're a beginner or an experienced trader, the onboarding process ensures you can start trading with ease. Here’s a step-by-step guide to help you get started.

Sign-Up Process

Go to www.activtrades.com and click on the “Open an Account” button located at the top right corner of the homepage.

- Full Name (as per your ID)

- Email Address (ensure it’s active for account verification)

- Phone Number (for security and communication)

- Country of Residence (to comply with regional regulations)

- Standard Account for regular traders

- Professional Account for experienced traders

- Islamic Account for swap-free trading (optional)

- Demo Account for risk-free practice

- Proof of Identity: Passport, national ID card, or driver’s license (must be valid and clearly visible).

- Proof of Address: A recent utility bill, bank statement, or official government correspondence (dated within the last 3 months).

- Approval Time: Typically, accounts are approved within a few hours, but it may take up to 1 business day depending on the completeness of your documents.

- No Fees for Account Opening: ActivTrades does not charge any fees to open an account. You’re only required to deposit funds when you’re ready to start trading.

-

Availability of Demo and Islamic Accounts:

- Demo Account: Ideal for beginners, offering a risk-free environment to practice with virtual funds (up to 100,000 in virtual currency).

- Islamic Account: Designed for Muslim traders, providing a swap-free trading environment in compliance with Sharia law.

-

Upgrading to a Professional Account:

- Having a financial portfolio exceeding 500,000 EUR

- Relevant trading experience

- Professional qualifications in the financial sector

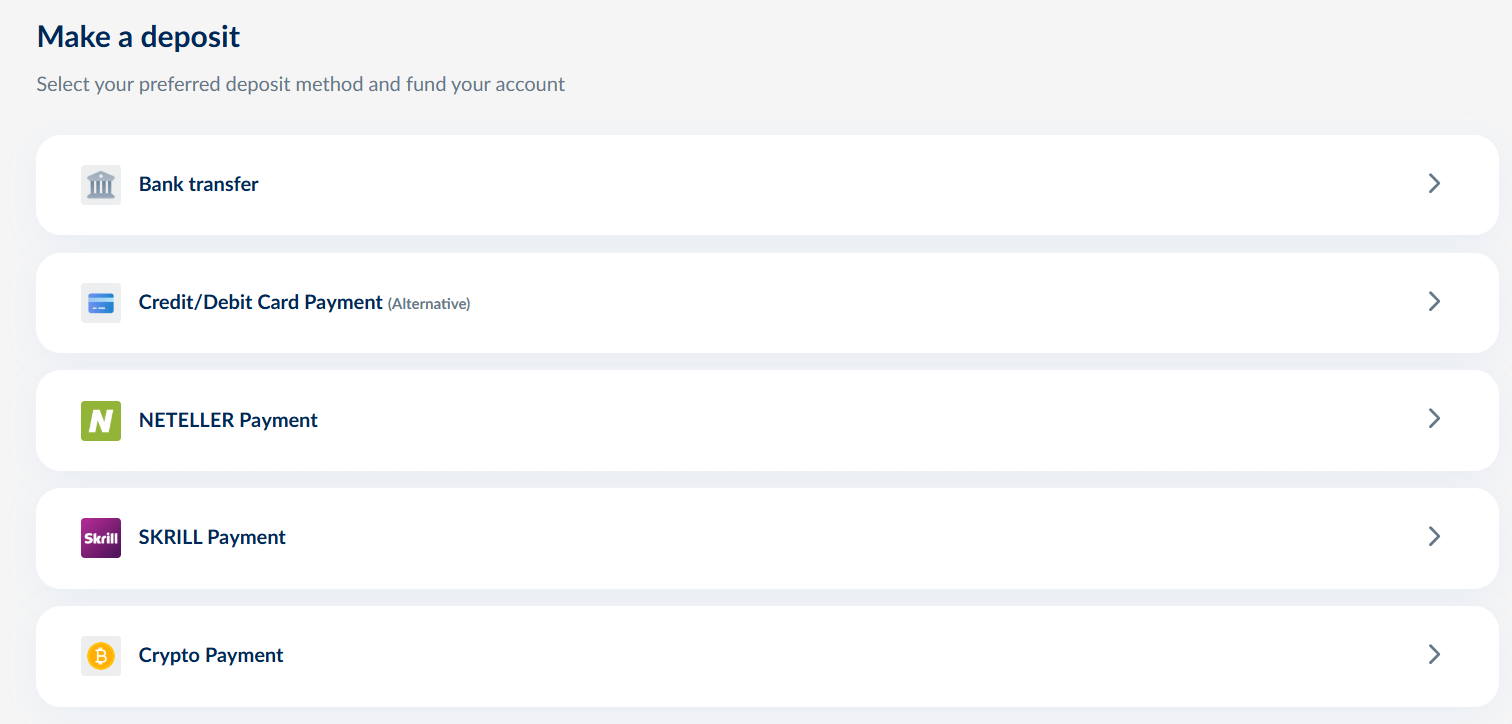

Deposits and Withdrawals

Managing your funds with ActivTrades is straightforward, with multiple deposit and withdrawal options designed for convenience, speed, and security. The broker ensures quick processing times, minimal fees, and flexible payment methods to meet the needs of traders worldwide.

Deposit Methods

ActivTrades offers several secure deposit options, allowing you to fund your account with ease:

- Processing Time:1–3 business days, depending on your bank and location.

- Fees:ActivTrades does not charge deposit fees, but intermediary banks may apply their own charges for international transfers.

- Best For:Large transactions due to higher transfer limits.

- Processing Time: Instant or within a few minutes.

- Fees:No deposit fees from ActivTrades.

- Best For:Quick deposits for immediate trading.

- Processing Time: Instant or within a few minutes.

- Fees:No fees from ActivTrades, but e-wallet providers may charge a small transaction fee.

- Best For:Fast, flexible funding with easy account management.

Minimum Deposit

ActivTrades has no minimum deposit requirement, making it accessible for both beginners and professional traders. However, it’s recommended to deposit an amount that aligns with your trading strategy and risk management plan.

Withdrawal Process

Withdrawals with ActivTrades are processed efficiently, with a focus on security and quick turnaround times.

Pro Tip: To ensure faster processing, submit withdrawal requests during business hours and double-check that all required documentation is up-to-date.

Customer Support and Education

Customer Support

ActivTrades offers 24/5 customer support, ensuring traders receive timely assistance during global market hours. Their support team is knowledgeable, responsive, and available in multiple languages to cater to their international client base.

Availability

Support is available 24 hours a day, five days a week, aligning with forex market hours to ensure you can get help whenever you need it.

Contact Methods

- +44 (0) 207 6500 567

- +44 (0) 207 6500 500

Educational Resources

To support traders in making informed decisions, ActivTrades offers a range of educational tools:

Pros and Cons of ActivTrades

PROS

CONS

While ActivTrades offers a secure and feature-rich environment, these limitations are important to consider based on individual trading preferences and activity levels.

Who Should Use ActivTrades?

ActivTrades caters to a diverse range of traders with flexible features and tailored account options, making it a reliable choice among forex brokers due to expert recommendations.

Whether you’re a beginner or a professional, ActivTrades offers the tools and support needed for effective trading.

Conclusion: Is ActivTrades the Right Broker for You in 2025?

ActivTrades is a strong choice for traders seeking a regulated, secure, and feature-rich platform. With advanced trading tools, competitive spreads, and comprehensive educational resources, it caters to both beginners and professionals. While inactivity fees and regional product limitations are drawbacks, its robust regulation and flexible account options make it a reliable broker for diverse trading goals in 2025.

FAQs

- E-wallets: Within 24 hours

- Credit/Debit Cards: 1–3 business days

- Bank Transfers: 3–5 business days

A globally recognized broker known for its advanced trading tools, competitive fees, and strong regulatory framework, designed to empower traders of all experience levels.