BlackBull Review 2025Explore BlackBull Markets' trading platforms, account options, fee structures, and regulatory compliance. Determine if it's the right broker for your trading goals in 2025.

Last updated

13.02.2025

Key highlights:

Why Choose BlackBull Markets?

Introduction

Founded in 2014, BlackBull Markets is a globally recognized brokerage specializing in forex, CFDs, and commodities trading. Headquartered in Auckland, New Zealand, the broker has built a strong presence worldwide, catering to retail and institutional traders alike. BlackBull Markets is known for its ECN trading environment, ultra-fast execution speeds, and deep liquidity, making it a preferred choice for traders seeking professional-grade conditions.

With nearly a decade of industry expertise, BlackBull Markets has established itself as a reliable and technologically advanced broker. Clients benefit from low-latency trading infrastructure, competitive spreads, and access to top-tier trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView.

The company’s mission is to provide traders with an institutional-grade trading experience, offering deep liquidity, direct market access, and a seamless execution process. Whether you're a beginner exploring forex trading or an experienced trader looking for a high-speed, low-cost trading environment, BlackBull Markets delivers the tools, security, and flexibility to enhance your trading journey.

Key Offerings

Diverse Tradable Instruments

BlackBull Markets provides a broad range of instruments across multiple asset classes, allowing traders to diversify their portfolios:

Cutting-Edge Trading Platforms

Traders at BlackBull Markets have access to industry-leading platforms for a seamless trading experience:

BlackBull Markets' ECN (Electronic Communication Network) execution model ensures ultra-fast trade execution, with average speeds under 75 milliseconds, helping traders avoid slippage and trade with precision.

Regulatory Compliance & Security

BlackBull Markets operates under strict regulatory oversight to ensure transparency and client protection:

The broker’s commitment to regulatory compliance, secure fund segregation, and strong client protection policies ensures a safe and professional trading environment.

Regulatory Compliance and Security

BlackBull Markets operates under the oversight of multiple regulatory authorities, ensuring a secure and transparent trading environment for its clients.

Regulatory Oversight:

BlackBull Markets is registered as a Financial Services Provider in New Zealand under FSP number 403326. This registration mandates adherence to stringent financial standards and regular audits, promoting transparency and integrity in operations

The broker's subsidiary, BBG Limited, is authorized and regulated by the FSA under license number SD045. This regulation allows BlackBull Markets to extend its services globally while maintaining compliance with international financial regulations.

Client Fund Protection:

To safeguard client assets, BlackBull Markets implements the following measures:

Client funds are held in segregated accounts with top-tier banks, such as ANZ Bank. This practice ensures that client funds are kept separate from the company's operational funds, providing protection in the unlikely event of insolvency.

BlackBull Markets offers negative balance protection to its clients, ensuring that traders cannot lose more than their deposited funds, even during periods of high market volatility.

These regulatory frameworks and security measures underscore BlackBull Markets' commitment to providing a safe and transparent trading environment for its clients.

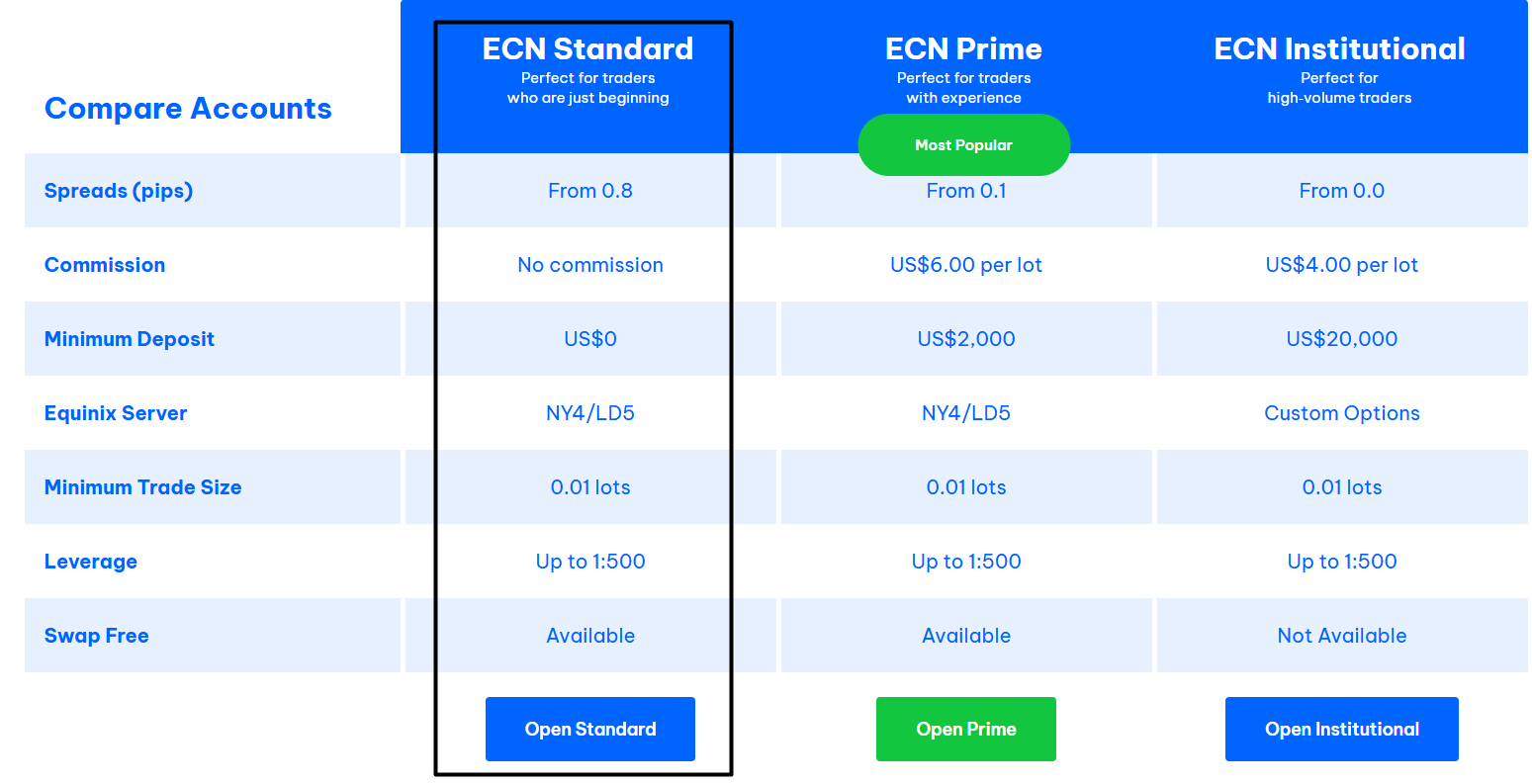

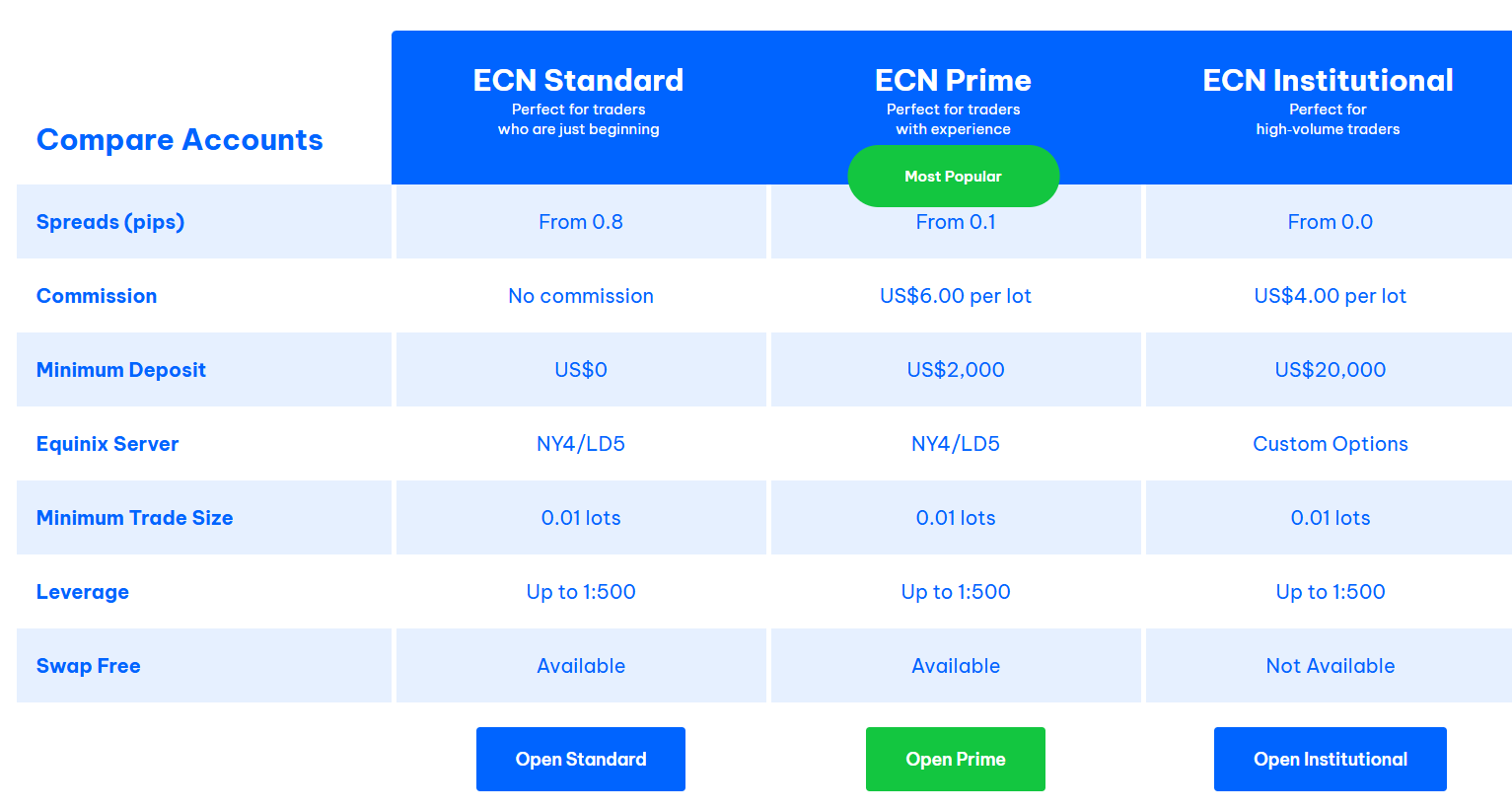

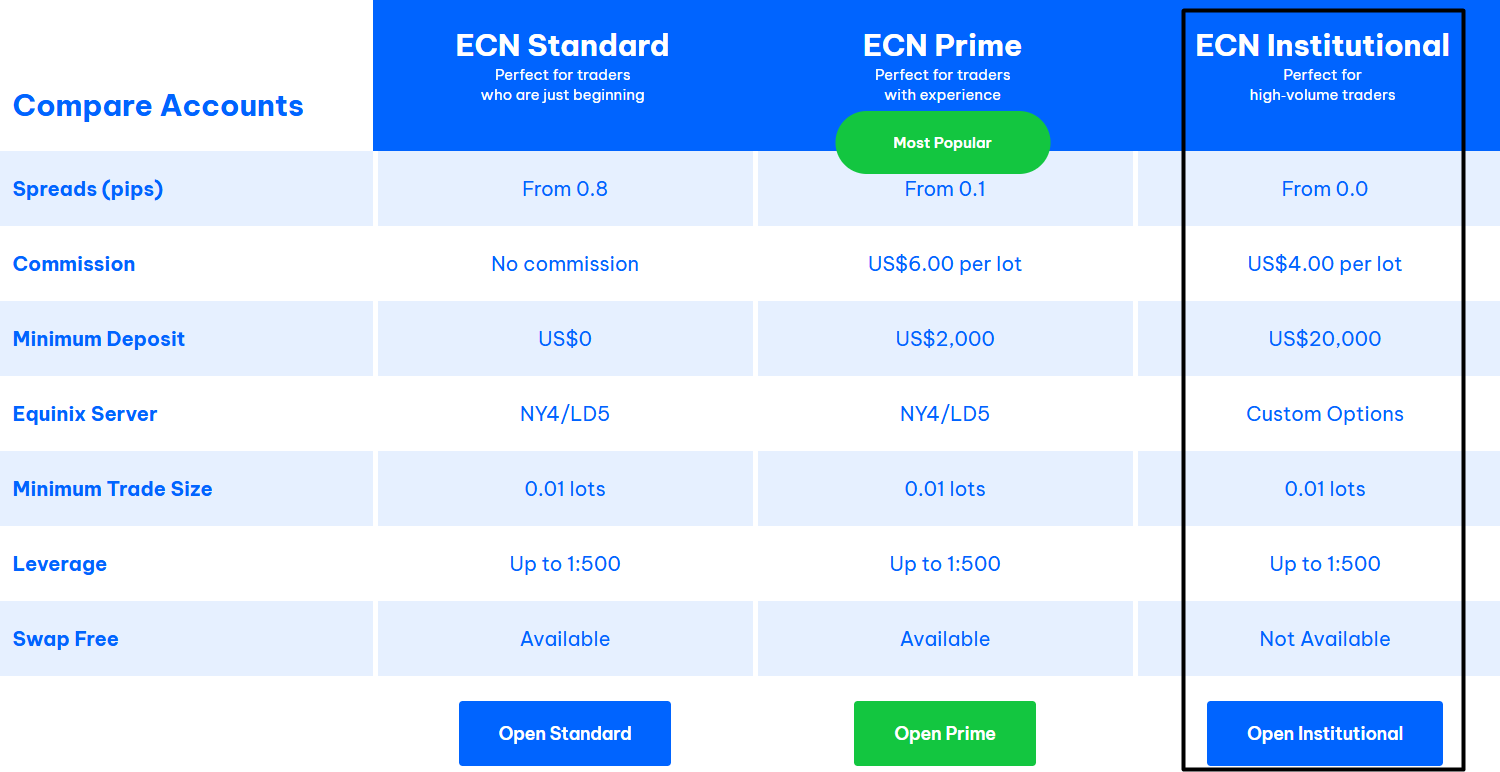

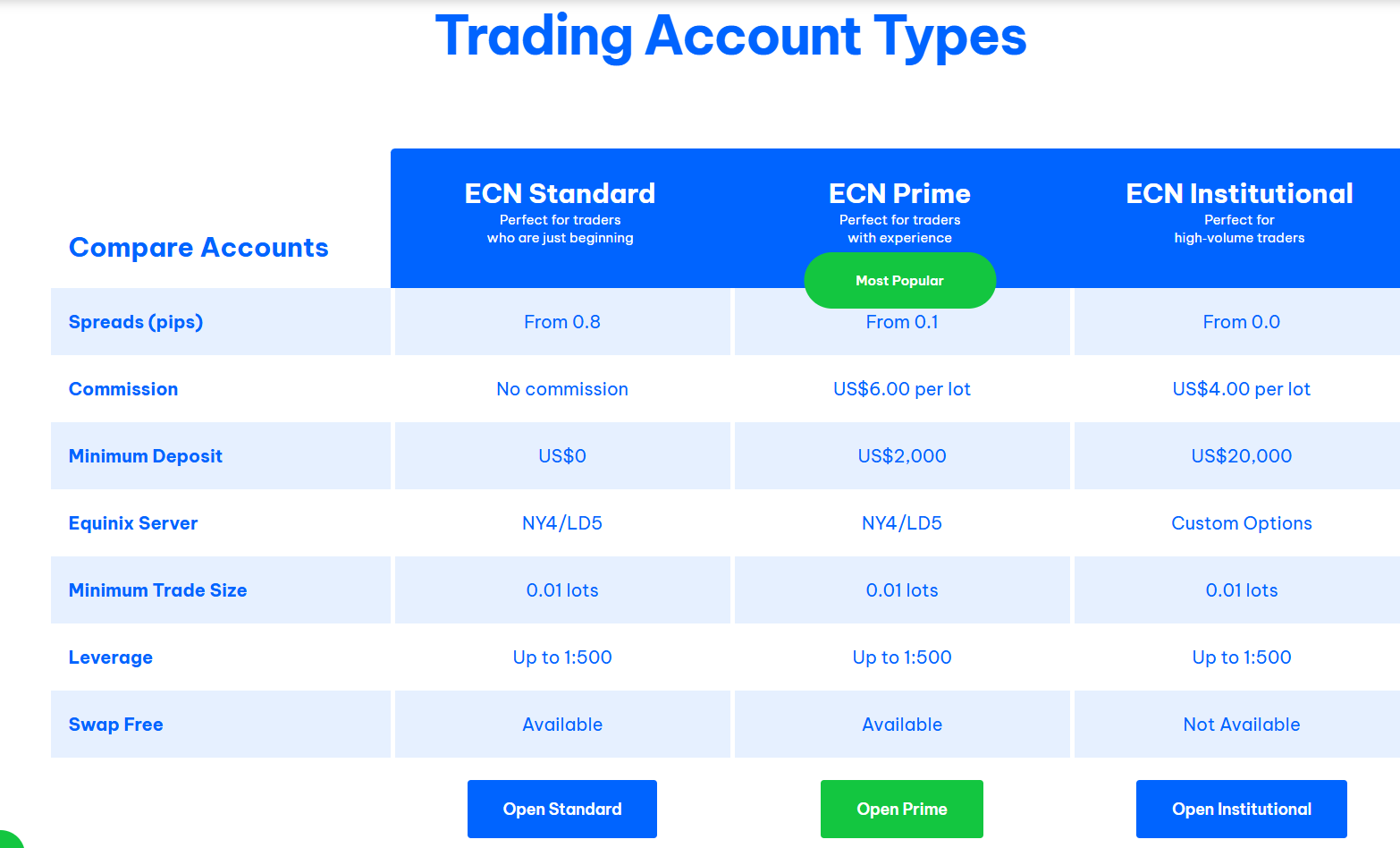

Trading Account Types at BlackBull Markets

BlackBull Markets offers a variety of trading accounts tailored to different trader needs, from beginners to institutional investors. Each account type is designed to provide competitive trading conditions with varying spreads, commissions, and deposit requirements.

ECN Standard Account (Best for Beginners)

Minimum Deposit: $0

Spreads: From 0.8 pips

Commission: No commission

Leverage: Up to 1:500

Minimum Trade Size: 0.01 lots

Equinix Server: NY4/LD5

Swap-Free Option: Available

Trading Account Types at BlackBull Markets

This account is ideal for traders who want a commission-free trading experience with competitive spreads. It’s well-suited for beginners looking to start trading with minimal capital.

ECN Prime Account (Best for Experienced Traders)

Minimum Deposit: $2,000

Spreads: From 0.1 pips

Commission: $6 per lot

Leverage: Up to 1:500

Minimum Trade Size: 0.01 lots

Equinix Server: NY4/LD5

Swap-Free Option: Available

The ECN Prime Account is designed for traders who require tighter spreads and don’t mind paying a commission per lot for better execution. It’s the most popular choice among experienced traders.

ECN Institutional Account (Best for High-Volume Traders)

Minimum Deposit: $20,000

Spreads: From 0.0 pips

Commission: $4 per lot

Leverage: Up to 1:500

Minimum Trade Size: 0.01 lots

Equinix Server: Custom Options

Swap-Free Option: Not Available

This account caters to institutional traders and hedge funds, offering the tightest spreads and the lowest commissions per lot.

Islamic (Swap-Free) Account

Available for traders who follow Shariah law, ensuring no overnight swap fees.

Offered under ECN Standard and ECN Prime accounts.

Traders can access all instruments with the same spreads and commissions as regular accounts.

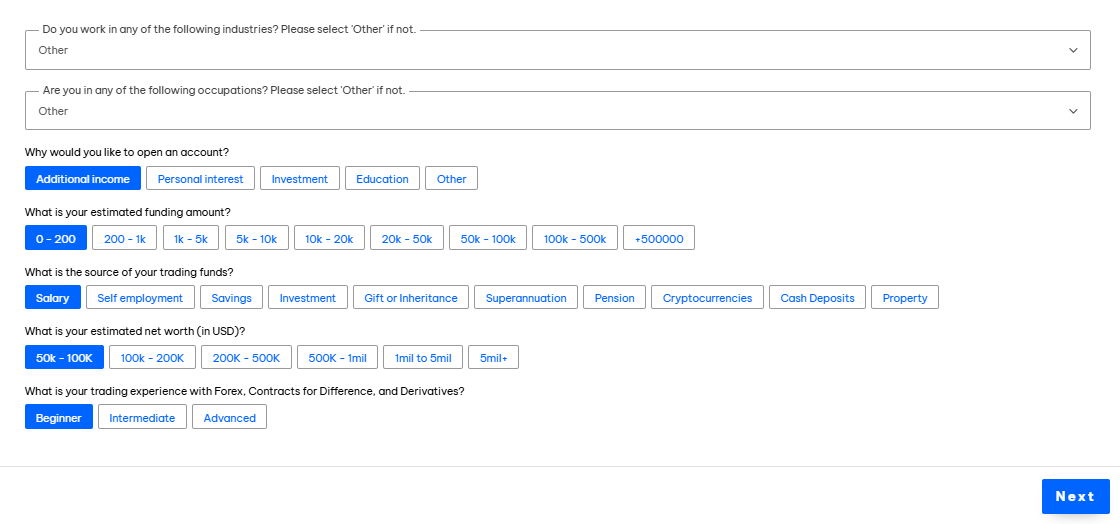

Professional Trader Account Availability

BlackBull Markets allows all traders to choose their preferred leverage up to 1:500 based on their declared trading experience during onboarding. Unlike some brokers, they do not have a separate professional account classification but instead provide traders with institutional-grade trading conditions based on their volume and deposit size.

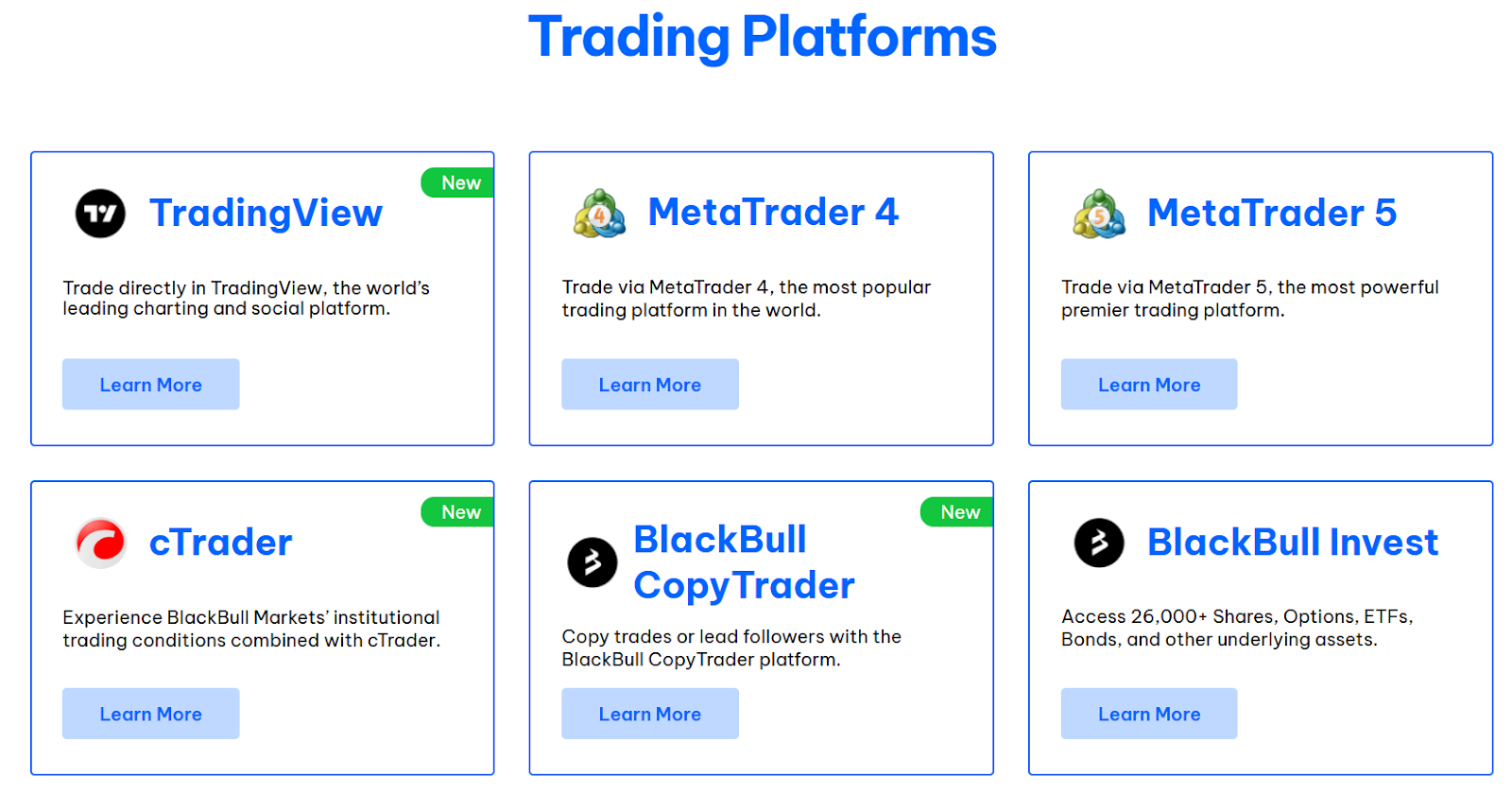

Trading Platforms

BlackBull Markets provides traders with a comprehensive selection of trading platforms, offering both industry-standard options and proprietary solutions. These platforms cater to traders of all levels, ensuring a seamless and feature-rich trading experience.

MetaTrader 4 (MT4) – The Classic Choice

Advanced Charting Tools: Multiple timeframes, technical indicators, and customizable chart settings.

Expert Advisors (EAs): Supports automated trading strategies and custom indicators.

Fast Execution: ECN connectivity for low-latency execution.

Mobile Compatibility: Available on Windows, macOS, iOS, and Android for trading on the go.

MetaTrader 5 (MT5) – The Next-Gen Platform

Expanded Asset Classes: Access to stocks, commodities, and indices in addition to Forex.

Enhanced Order Types: More pending order options than MT4 for better trade execution.

Economic Calendar: Integrated economic events and news updates.

Advanced Strategy Testing: Backtest trading algorithms with improved accuracy.

BlackBull WebTrader – Proprietary Platform

No Downloads Required: Access your trading account via any browser.

Real-Time Market Analysis: Integrated charts, news updates, and order execution tools.

User-Friendly Interface: Optimized for both beginners and professional traders.

cTrader – Built for Professionals

Customizable Interface: Advanced layout options for personalized trading setups.

Algorithmic Trading: Automate strategies with cAlgo integration.

Level II Pricing: Enhanced order book visibility for precise execution.

TradingView – Social & Analytical Trading

Powerful Charting Tools: Extensive indicators and drawing tools.

Trade Directly on Charts: Seamless order placement from within TradingView.

Community Insights: Engage with other traders and analyze market sentiment.

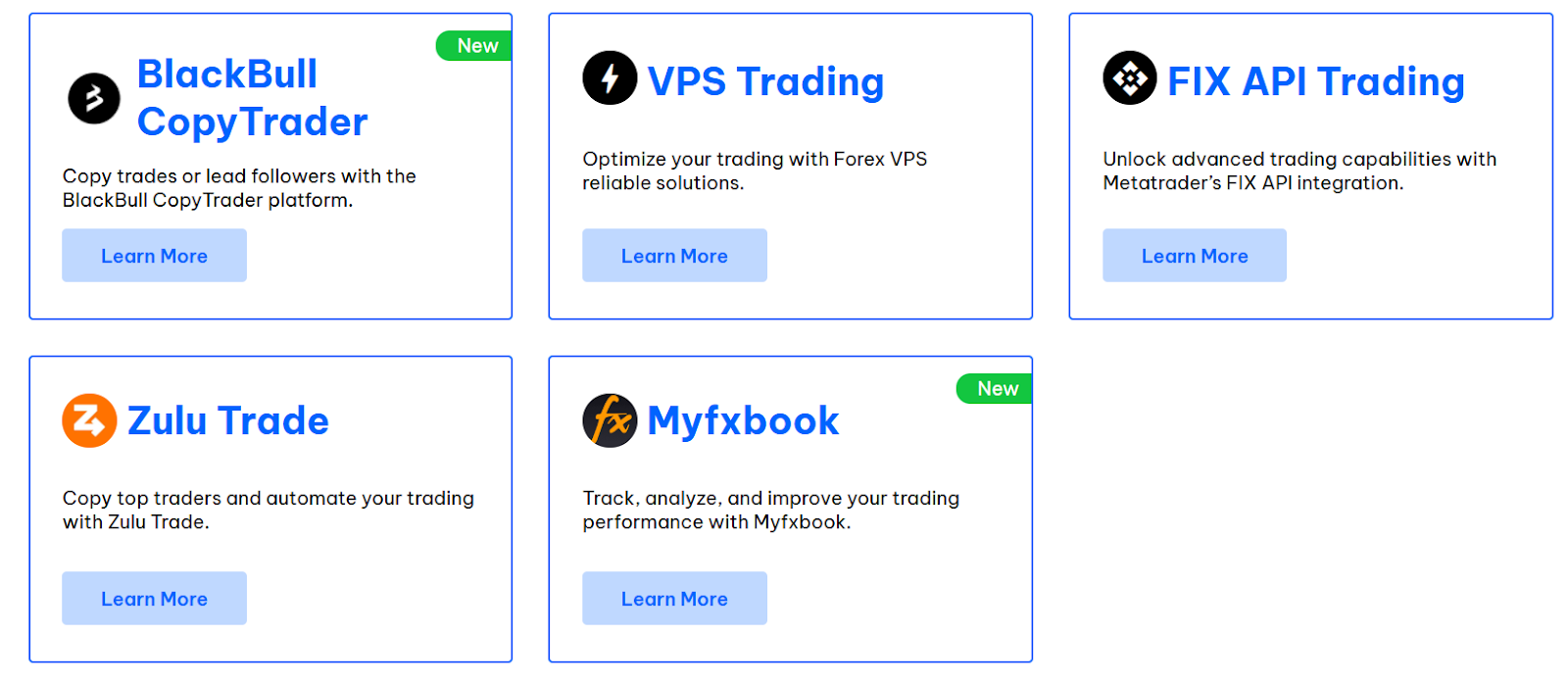

BlackBull CopyTrader – Social Trading

Copy Top Traders: Follow and replicate the strategies of successful traders.

Flexible Risk Management: Adjust lot sizes and risk exposure.

User Experience Across Devices

All BlackBull Markets platforms are available on desktop, web, and mobile, ensuring traders can monitor and manage trades from anywhere. Whether using Windows, macOS, iOS, or Android, traders can access their accounts with ease.

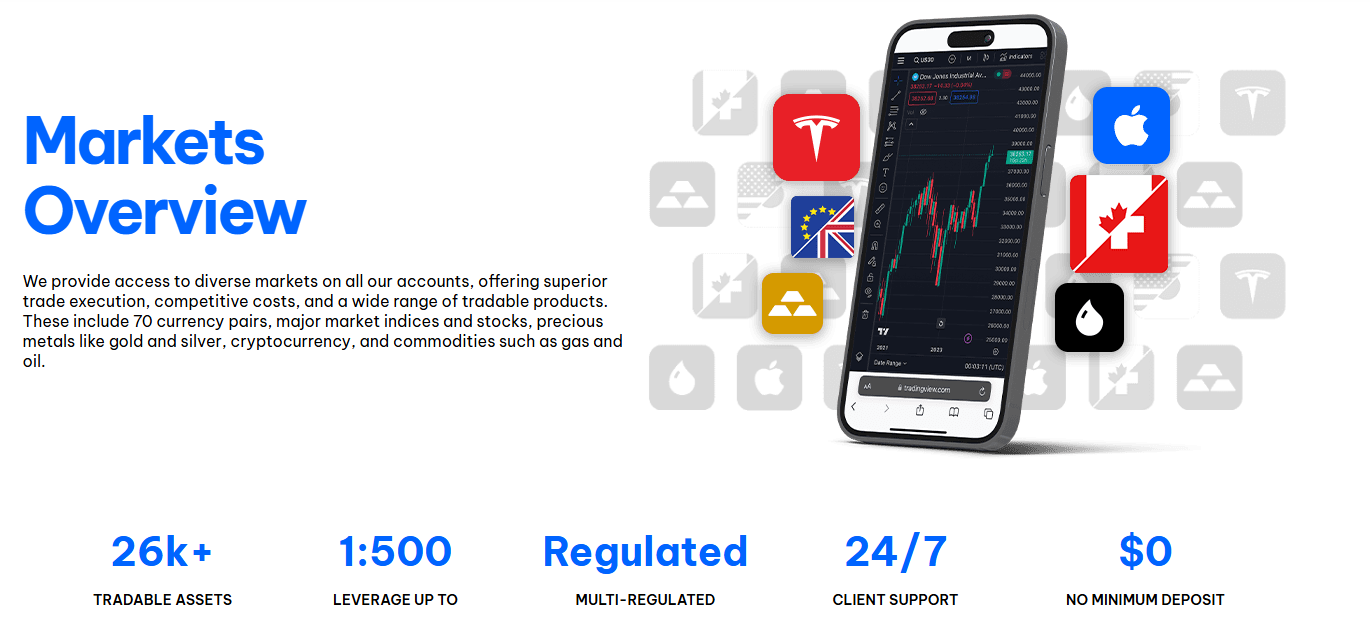

Tradable Instruments and Leverage

BlackBull Markets provides traders with access to a broad range of financial instruments across multiple asset classes, ensuring portfolio diversification and global market exposure.

Available Trading Instruments

BlackBull Markets offers a wide selection of tradable assets, including:

Leverage Options

BlackBull Markets provides flexible leverage options tailored to different trader profiles and regulatory jurisdictions:

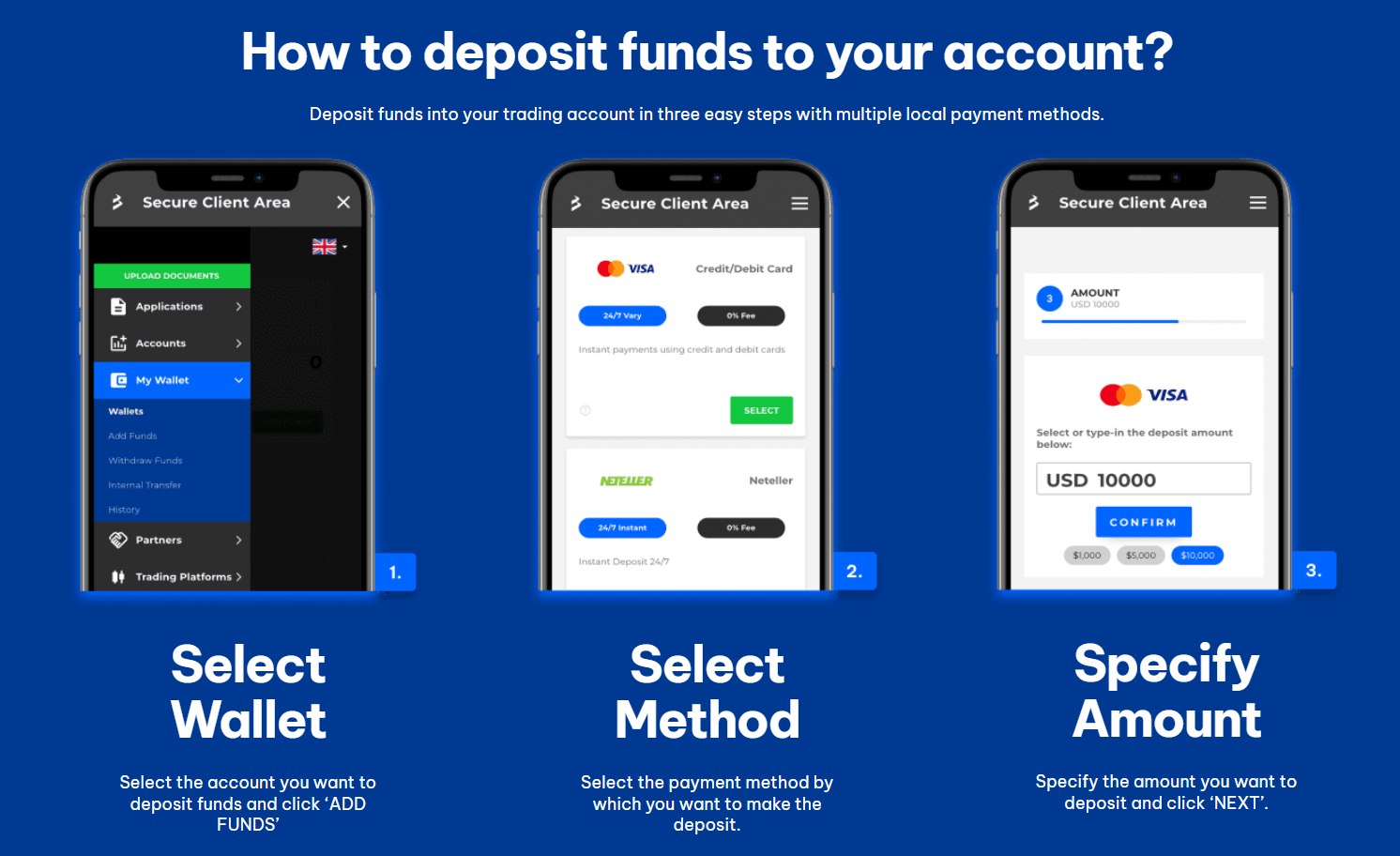

Deposit and Withdrawal Methods

BlackBull Markets offers a fast, secure, and transparent funding and withdrawal process, catering to traders worldwide. With multiple deposit and withdrawal options, traders can manage their funds efficiently.

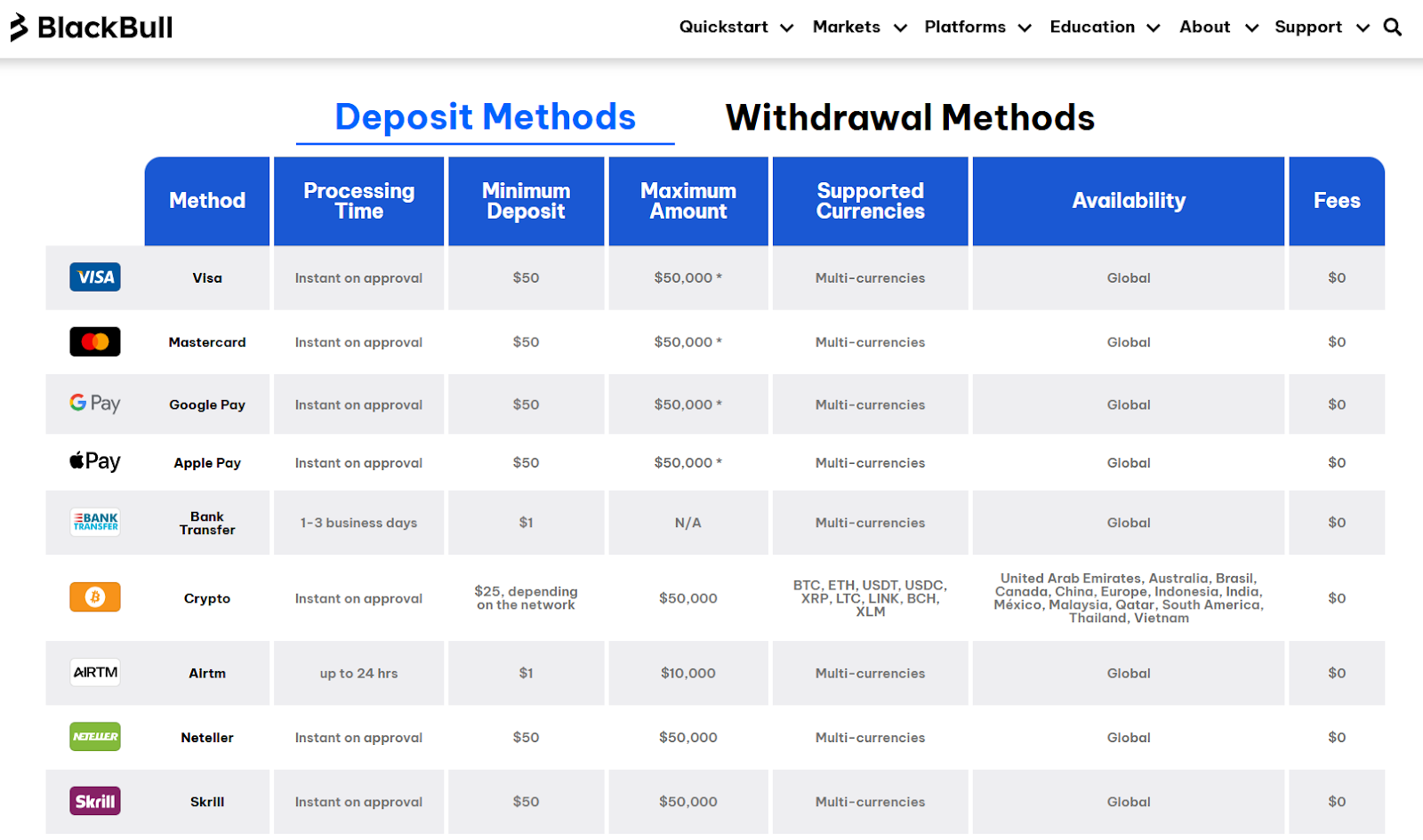

Deposit Methods

BlackBull Markets supports a variety of funding methods, ensuring convenience and accessibility:

Most deposits are processed instantly, allowing traders quick access to trading capital. No deposit fees are charged by BlackBull Markets.

Withdrawal Methods

Withdrawals are processed using the same method as deposits to comply with AML (Anti-Money Laundering) policies. Processing times vary by method:

- Credit/Debit Cards & E-Wallets: 1 business day

- Bank Transfers: 1-3 business days

- Crypto Withdrawals: Processed within 24 hours, network fees may apply

- Minimum Withdrawal: $50 for most methods

A flat withdrawal fee of $5 per transaction applies to most payment methods.

Security & Transaction Policies

BlackBull Markets ensures a secure, efficient, and transparent transaction process, allowing traders to deposit and withdraw with confidence.

Fees and Charges

BlackBull Markets maintains a transparent and competitive fee structure to support traders with different strategies. Below is a detailed breakdown of the trading and non-trading fees associated with the platform.

-

Trading Fees:

-

Spreads: BlackBull Markets offers variable spreads depending

on the account type:

- ECN Standard: Spreads start from 0.8 pips, with no commission.

- ECN Prime: Spreads start from 0.1 pips, with a $6.00 commission per lot.

- ECN Institutional: Spreads start from 0.0 pips, with a $4.00 commission per lot.

-

Commissions:

- The ECN Standard account is commission-free.

- The ECN Prime account has a $6 per lot commission.

- The ECN Institutional account has a $4 per lot commission.

- Swap/Overnight Fees: Traders holding overnight positions may incur swap fees based on interest rate differentials between currency pairs. Islamic (Swap-Free) accounts are available for traders who require them.

-

Spreads: BlackBull Markets offers variable spreads depending

on the account type:

-

Non-Trading Fees:

- Inactivity Fee: No inactivity fee applies, making BlackBull Markets cost-effective for traders who take breaks from trading.

- Currency Conversion Fees: Deposits and withdrawals in a currency different from the account’s base currency may be subject to conversion fees.

- Withdrawal Fees: A $5 withdrawal fee applies for each withdrawal.

- Deposit Fees: No fees are charged on deposits.

Trading Conditions and Policies

BlackBull Markets offers a flexible and trader-friendly environment with no restrictions on trading strategies. Traders can execute various strategies with confidence, benefiting from fast execution and minimal latency.

- Scalping: Fully permitted, allowing traders to take advantage of short-term market movements.

- Hedging: Allowed, enabling traders to manage risk effectively by opening offsetting positions.

- Expert Advisors (EAs) and Algorithmic Trading: Fully supported on MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, allowing automated strategies to run seamlessly.

- Arbitrage Trading: No explicit restrictions, but traders should ensure compliance with standard market execution rules.

- Execution Speed: According to feedback from broker representatives, BlackBull Markets achieves execution speeds of less than 75 milliseconds. With execution times under 100 milliseconds, traders can minimize slippage and secure optimal entry and exit prices.

- Slippage: While rare due to fast execution, slippage may still occur in extreme market volatility. BlackBull Markets strives to execute trades at the best available price.

- Margin Call: Issued at 70% margin level, alerting traders to add funds or reduce exposure.

- Stop-Out Level: Triggered at 50% margin level, leading to automatic position closure to prevent excessive losses.

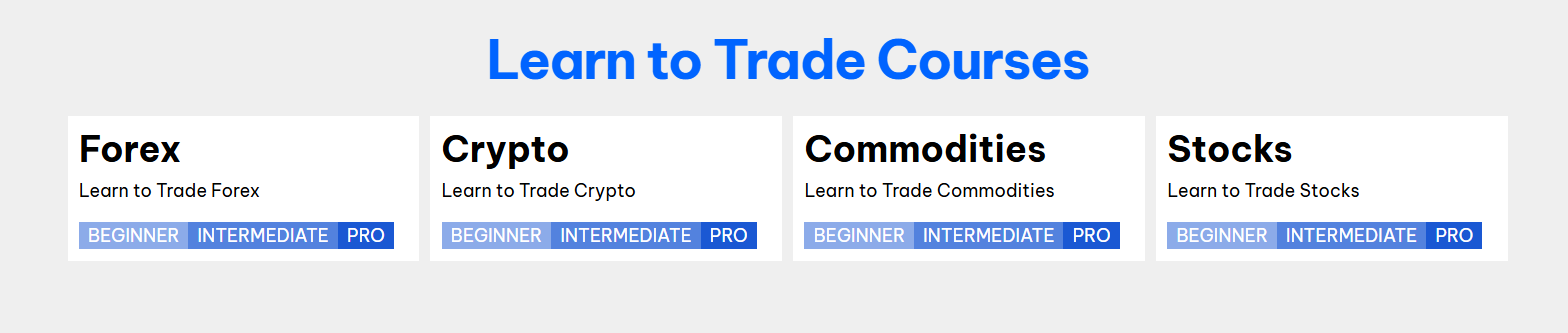

Educational Resources and Support

Comprehensive Learning Materials

BlackBull Markets provides a structured learning experience for traders at all levels, offering specialized courses and training across different asset classes:

Covers fundamental and technical aspects for beginner, intermediate, and professional traders.

Explores cryptocurrency markets, trading strategies, and risk management.

Focuses on trading gold, silver, oil, and other key commodities.

Offers insights into stock market fundamentals, charting techniques, and portfolio management.

Each course is tailored to beginner, intermediate, and pro traders, ensuring a structured learning path.

- Daily Market Analysis: Regular updates on major financial events and price movements.

- Live Webinars: Sessions with expert traders covering market trends and trading strategies.

- Trading Guides & Research Reports: In-depth articles on trading strategies, indicators, and market opportunities.

Customer support service

BlackBull Markets provides 24/7 customer support, ensuring traders receive timely assistance. Available support channels include:

Reach out via [email protected] for general queries and platform assistance.

Access real-time support via the Live Chat option on the website.

Communicate with the team on WhatsApp for quick responses.

With multilingual support and round-the-clock availability, BlackBull Markets ensures traders can get the help they need whenever they need it.

Pros and Cons

PROS

Supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView, along with VPS trading and FIX API for institutional traders.

Multiple funding options with zero deposit fees and a $5 withdrawal fee for most methods.

CONS

BlackBull Markets stands out for its ECN execution, regulation, and professional trading environment, making it ideal for serious traders.

Conclusion

BlackBull Markets is a well-established brokerage offering ECN trading, low spreads, and fast execution speeds. It caters to traders of all experience levels with its MetaTrader 4, MetaTrader 5, cTrader, and TradingView platforms. The broker is regulated by the FMA (New Zealand) and FSA (Seychelles), ensuring a secure and transparent trading environment.

For beginners, the ECN Standard account provides a no-commission structure, while experienced traders may prefer the ECN Prime or Institutional accounts for tighter spreads and professional features. BlackBull Markets supports Forex, stocks, indices, commodities, and cryptocurrencies, making it a versatile option for traders looking for market diversity.

If you're seeking an institutional-grade trading experience with deep liquidity, BlackBull Markets is a solid choice. For more broker reviews and insights, visit wheretotrade.ai to compare brokers and find the best trading solutions.

Frequently Asked Questions (FAQs)

BlackBull Markets is a globally recognized broker offering a diverse range of trading instruments, advanced platforms, and a strong regulatory framework, catering to traders of all experience levels.